Bitcoin: Bullish Signals As ETF Demand Returns

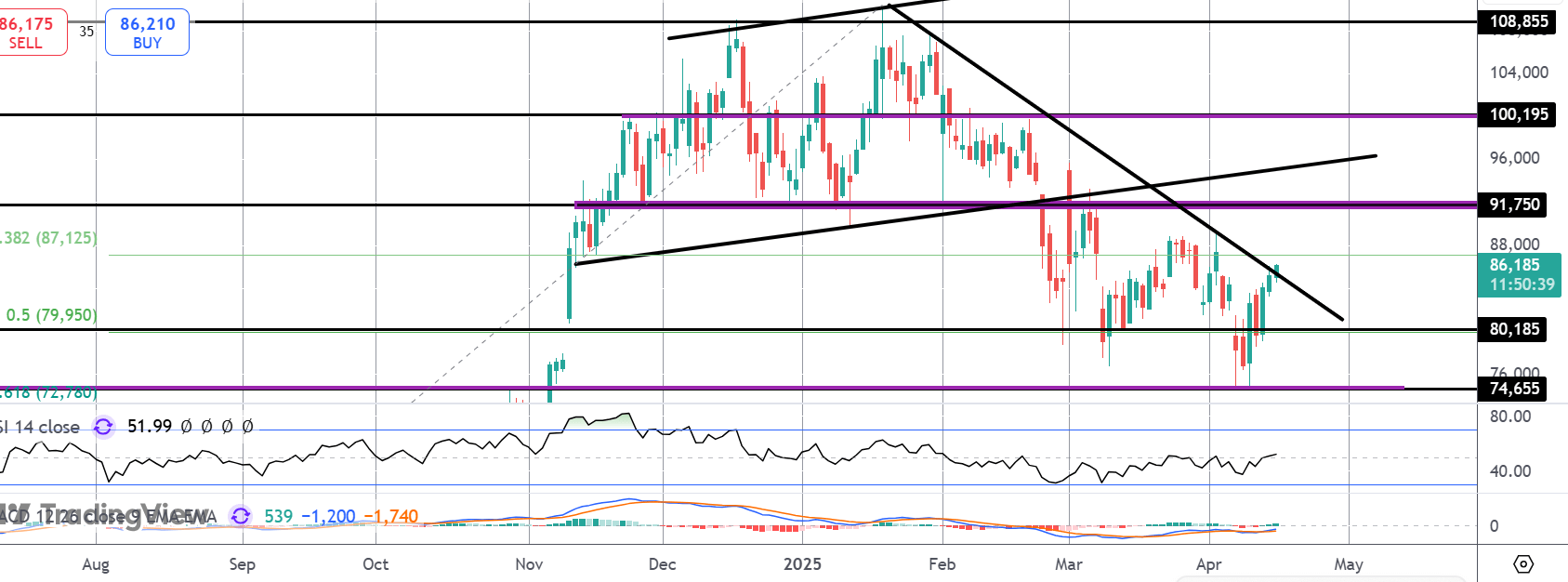

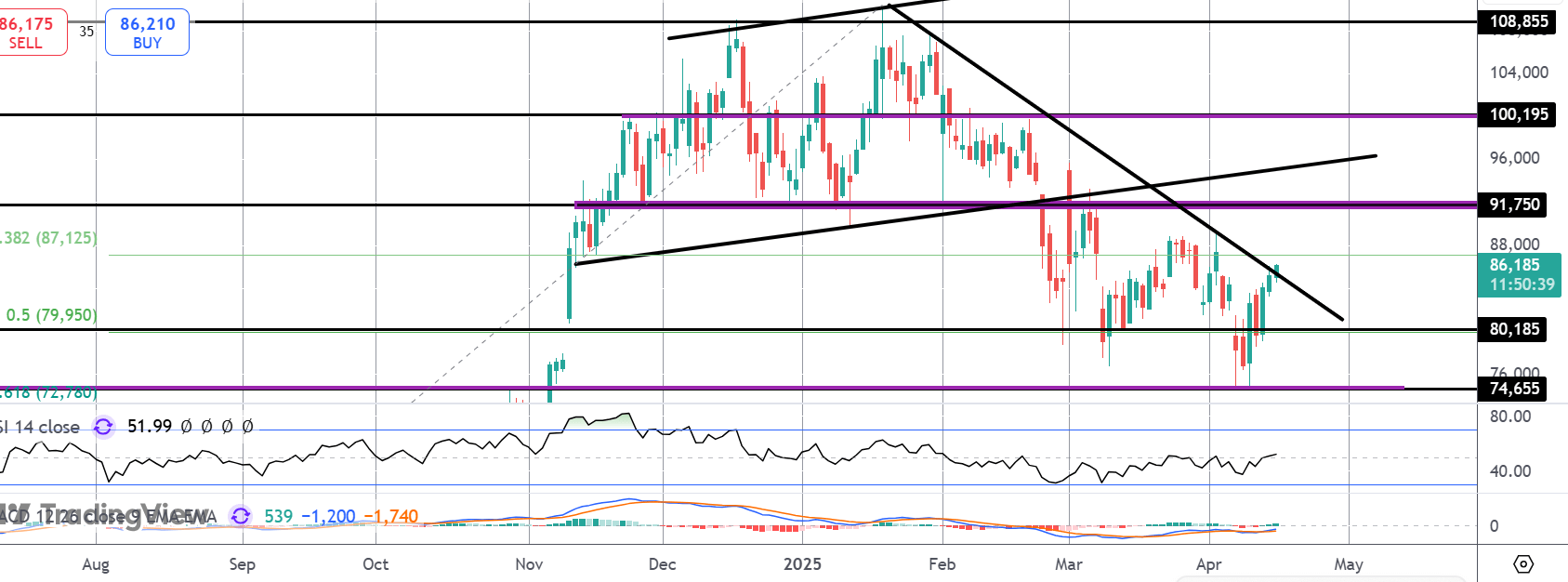

BTC Trend Line Break

Bitcoin prices are on watch today with the futures market testing the bear trend line from YTD highs. Following a sharp reversal higher off the $75k lows, the market is now showing signs of a potential breakout. BTC is now up around 15% off the post-tariff lows and with clear bullish divergence into those lows, the technical picture is starting to look more encouraging for a fresh push higher.

Institutional Demand

Indeed, the latest industry data reports that institutional demand has been returning to market with BTC ETF’s breaking a seven-day streak of outflows to record net gains yesterday. Given the heavy pullback in BTC over recent months and the sharp outflows we’ve seen from mainstream players, there is plenty of room for the return of institutional demand to drive a fresh rally in BTC.

US/China Trade Optimism

The lift in sentiment is being attributed to Trump’s concessions on trade with certain Chinese tech products being exempt from reciprocal tariffs, creating optimism that the path to a broader trade deal is now in sight. The escalation in the US/China trade war has been a major headwind for risk markets. However, if traders start to get the sense that the two sides are closer towards beginning trade negotiations, risk appetite has plenty of room to recover, with BTC set to benefit firmly in such conditions.

Technical Views

BTC

The rally off the $75K lows is gathering pace with the market now testing above the bear trend line from YTD highs. While above $80k, focus is on a test of the $91,750 level next which is a major pivot for the market. A break back above this level should alleviate bearish risks, putting focus back on the current ATH.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.