Copper Traders Waiting On Fresh Directional Drivers

Copper Congestion Continues

Copper prices remain weak on Tuesday with the futures market griding lower, following a similar grind higher yesterday. The market has been caught in a phase of congestion over the last week or so, seeing a slow grind lower from the 4.8010 level. However, support at 4.5785 continues to hold for now and while this level remains, focus is on an eventual turn higher again.

Excess Supply Forecasts

Focus has recently shifted onto excess supply forecasts for copper. The International Copper Study Group last week doubled its forecasts for an inventories surplus this year, citing weaker demand expectations and increased supply. Indeed, news of the recent uptick in US copper inventories seemed to endorse this outlook, as copper flooded back into US with factories looking to protect themselves from tariffs after Trump announced an investigation into copper imports.

US/China Trade Talks

Copper prices have also been capped by a lack of follow through on US/China trade talks. Initial optimism in response to news of the 90-day tariff reduction window has since faded and commodities are seen drifting lower. However, copper prices remain vulnerable to a fresh spike higher on any positive incoming headlines. As such, it could be a case of wait-and-see for copper. The risk, however, is that the longer we go without fresh updates, the deeper copper prices could move on the view that a trade deal is less likely to be reached.

Technical Views

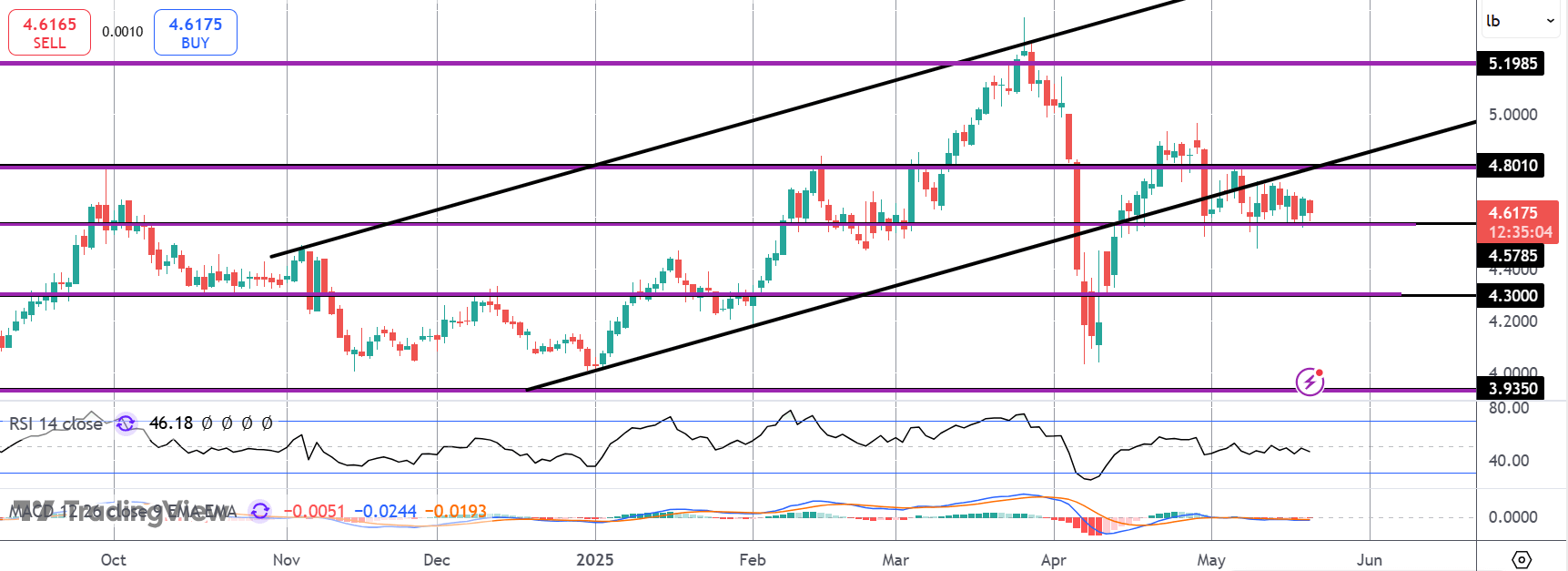

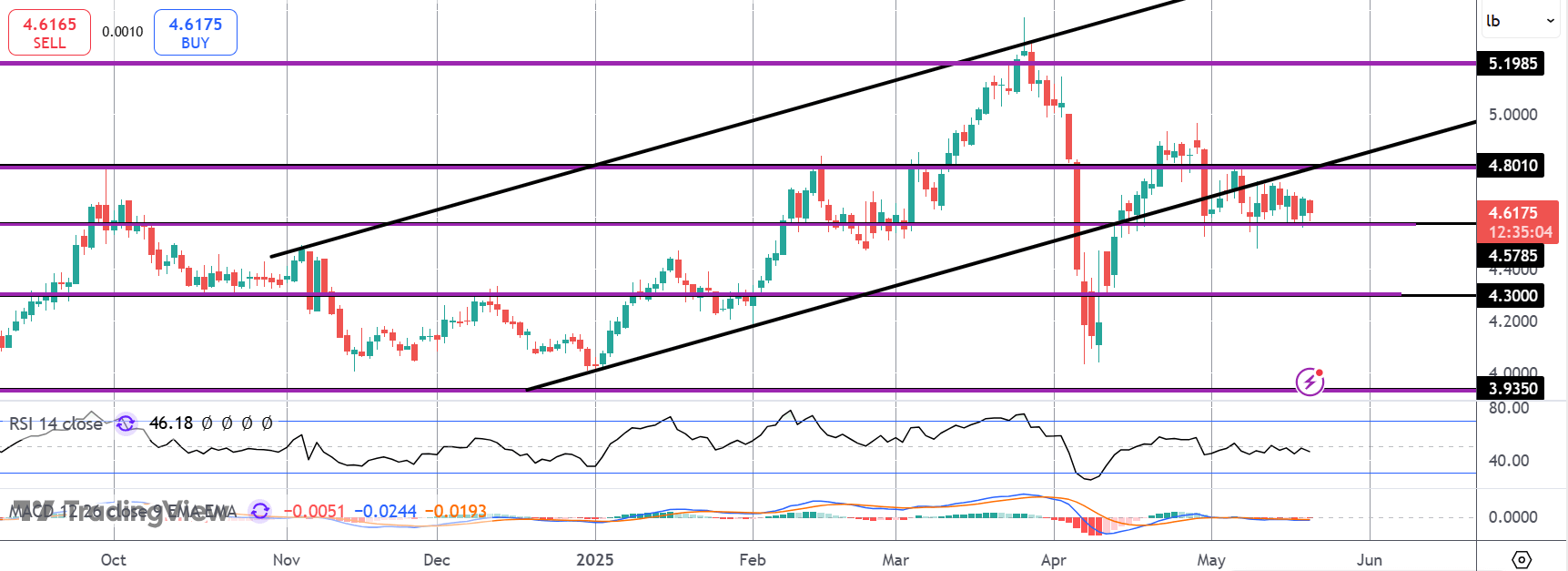

Copper

For now, copper prices remain hemmed in between 4.5785 support and 4.8010 resistance, with price sitting below the broken bull channel. While support holds, focus is on a fresh move higher back towards the 5.1985 level. To the downside, 4.30 is the next support to watch if we break lower.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.