Crude Rally Stalls As OPEC+ Expectations Weigh

US Economic Fears

Crude prices are pulling back today with the futures market in the red as yesterday gains start to reverse. Price had spiked higher initially yesterday amidst a broad pickup in risk appetite linked to a weaker US ADP print and higher near-term Fed easing expectations. However, with the market now widely expecting a weaker NFP print today fears over the health of the US economy are starting to eat at the demand outlook in crude, causing some room for pause here following yesterday’s knee jerk move higher.

OPEC+ Expectations

Alongside US economic fears, traders are also bracing for a fresh output hike from OPEC+ with the group due to meet this weekend. The group has raised output steadily over recent months and looks set to do so again this week which, if confirmed, should cause further headwinds for crude bulls.

US/China Trade

A fresh output rise from OPEC+ could be made worse unless we see a breakthrough on trade in the coming days. The US/China 90-day tariff suspension window is due to end next week on Wednesday July 9th and unless a deal is made or the window is extended, tariffs will increase again. This will put global trade under fresh strain and add further weight to the weakened crude demand outlook, sending prices lower near-term. However, if a last-minute deal is agreed, this could instead spark a fresh rally in crude prices.

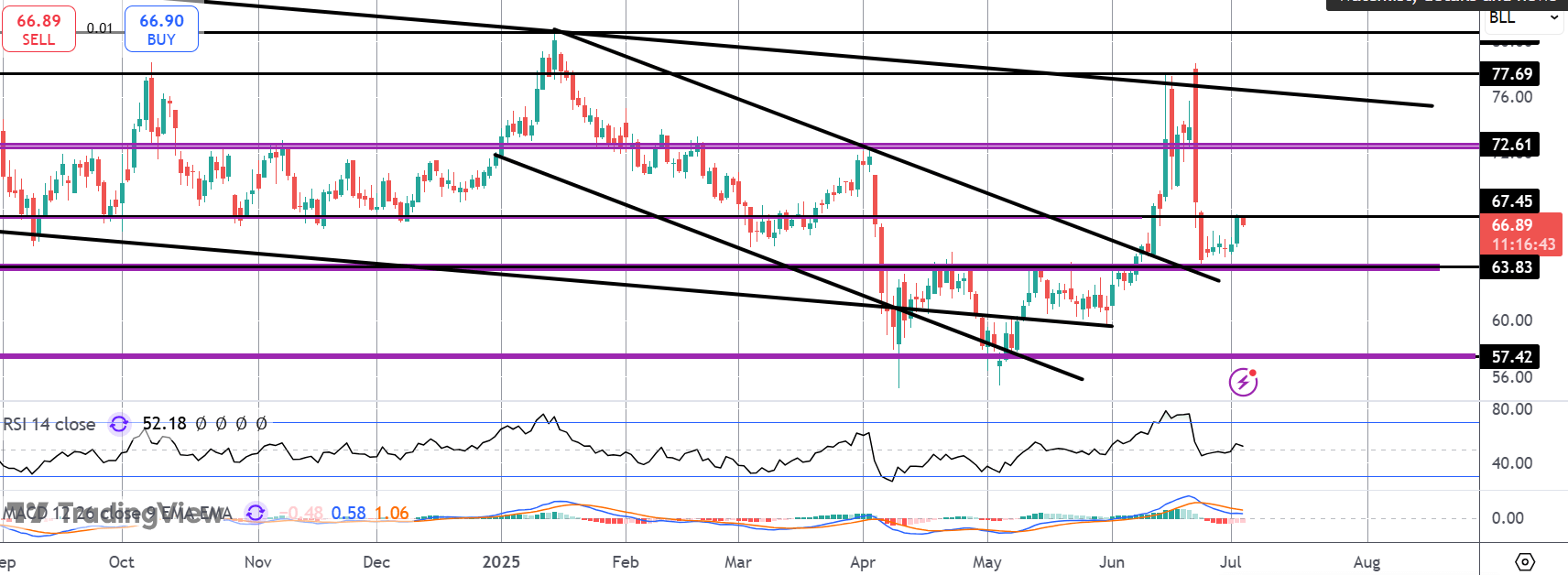

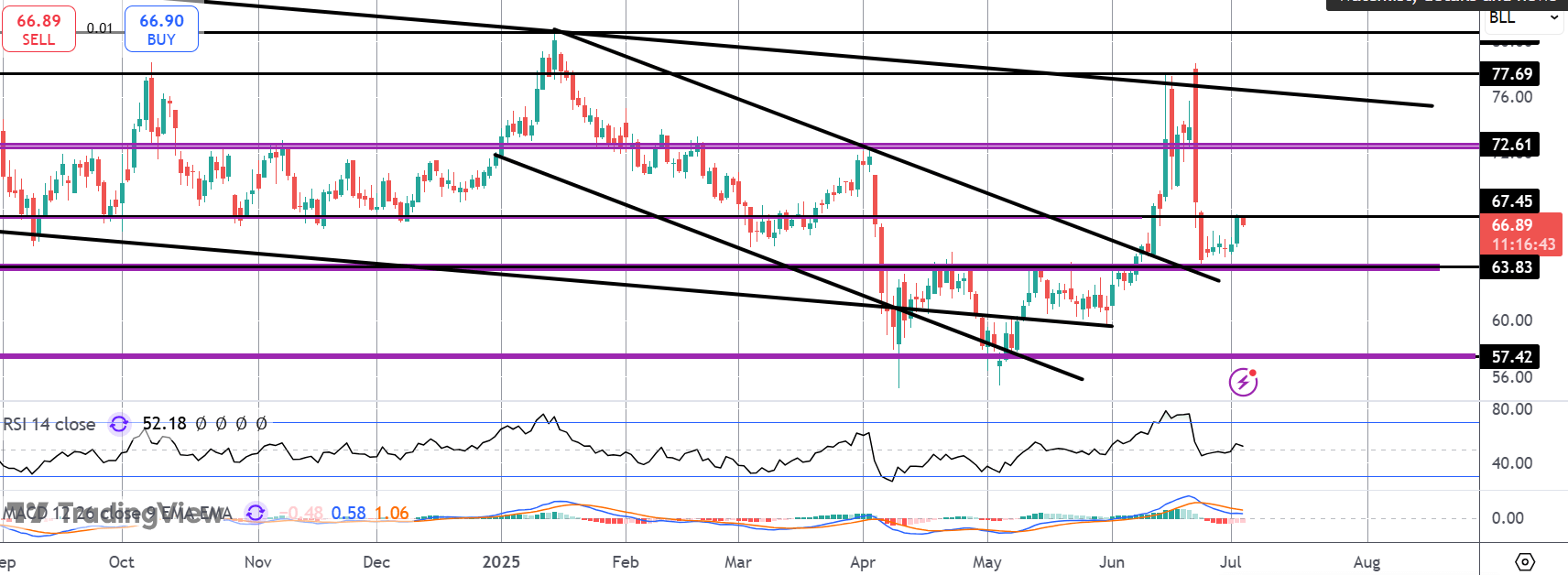

Technical Views

Crude

The rally in crude has stalled for now into the 67.45 level. While below here, range bound action between that level and support at 63.83 looks likely. Back above there, however, focus returns to 72.61 above as the next bull target. A break of 63.83, alternatively, will turn focus to deeper support at 57.42 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.