Oil Under Pressure

Oil prices are turning lower again through the back end of the week with crude futures firmly in the red on Thursday morning. The move comes amidst speculation that a Russia-Ukraine peace deal might soon materialise. Trump has put added pressure on Ukraine to approve a US-drawn peace plan. If the deal is agreed, this could see the lifting of sanctions on Russia and the return of Russian crude to the wider market. Given that oversupply concerns have been a key theme of markets recently, the prospect of returning Russian supply is leaning on sentiment here.

Oversupply Concerns

Looking ahead, any positive news regarding progress towards a deal is likely to see crude prices falling further as this dynamic is amplified. A series of industry forecasts recently from the IEA, EIA and OPEC have all warned of near-term price risks as a result of weaker demand and elevated supply levels. On the other hand, if Ukraine rejects the deal and it looks as though momentum towards any sort of peace deal is fading, crude pries might well spike higher again.

USD in Focus

Away from that issue, a firmer USD today is also weighing on commodities prices. The Fed cut rates as expected yesterday but the guidance issued alongside the rate decision was relatively muted. Traders are now in wait-and-see mode ahead of next week’s US labour market data. However, unless we see fresh weakness in those readings, USD might begin to drift higher again as traders eye a lower chance of a near-term rate cut, keeping oil prices skewed lower.

Technical Views

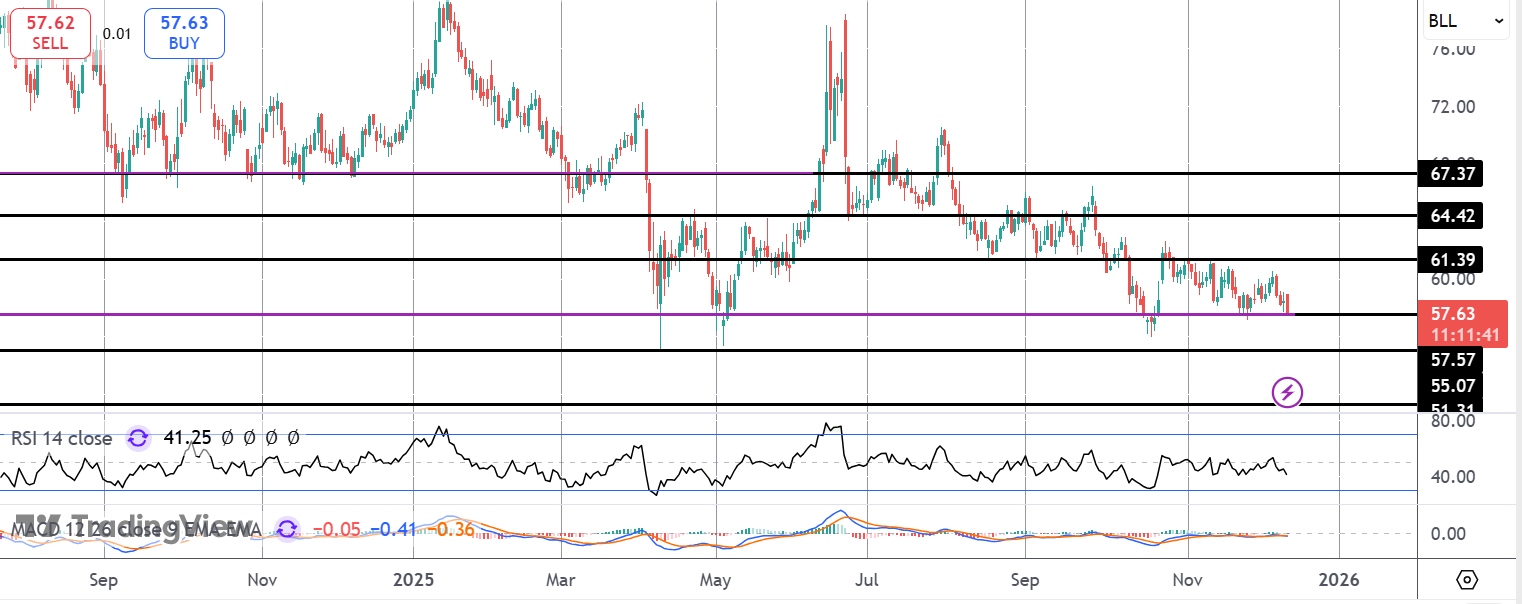

Crude

The market is now once again testing support at the 57.57 level. This has been a key support level for the market this year and a break here will be firmly bearish, targeting 55.07 YTD lows next and 51.31 below. Topside, bulls need to get back above 61.39 to alleviate bearish risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.