Crude Slips on Weak China Data - US GDP Next

Crude Slide Continues

Crude prices are continuing to push lower through the middle of the week with the futures market down almost 10% from recent highs. The move lower comes despite some positive signals in the trade war landscape recently with growing optimism over a descaling of the tariffs between the US and China.

Weak China Data

However, it seems crude traders are currently more concerned with recent data weakness out of China with export orders seen crashing in April and manufacturing activity hitting its lowest levels in a year. With the US/China trade war ongoing for now, there are fears over the growing impact on the Chinese economy with negative effects continuing to build while tariffs remain in place.

US Econ Data

Looking ahead today, traders will also be watching the latest US GDP gauge. If economic activity is seen to have contracted as sharply as expected over Q1 this should feed into bearish sentiment, further weighing on demand expectations in crude. Indeed, the latest US consumer confidence data this week showed that expectations have weakened materially against the tariff backdrop.

Bullish Drivers

However, despite the current bearish sentiment, crude prices remain vulnerable to a spike higher in response to any incoming goods news on trade. Any further US/China developments will be firmly bullish for crude, particularly if either side starts to scale back tariffs, bolstering the chances of a trade deal being agreed.

Technical Views

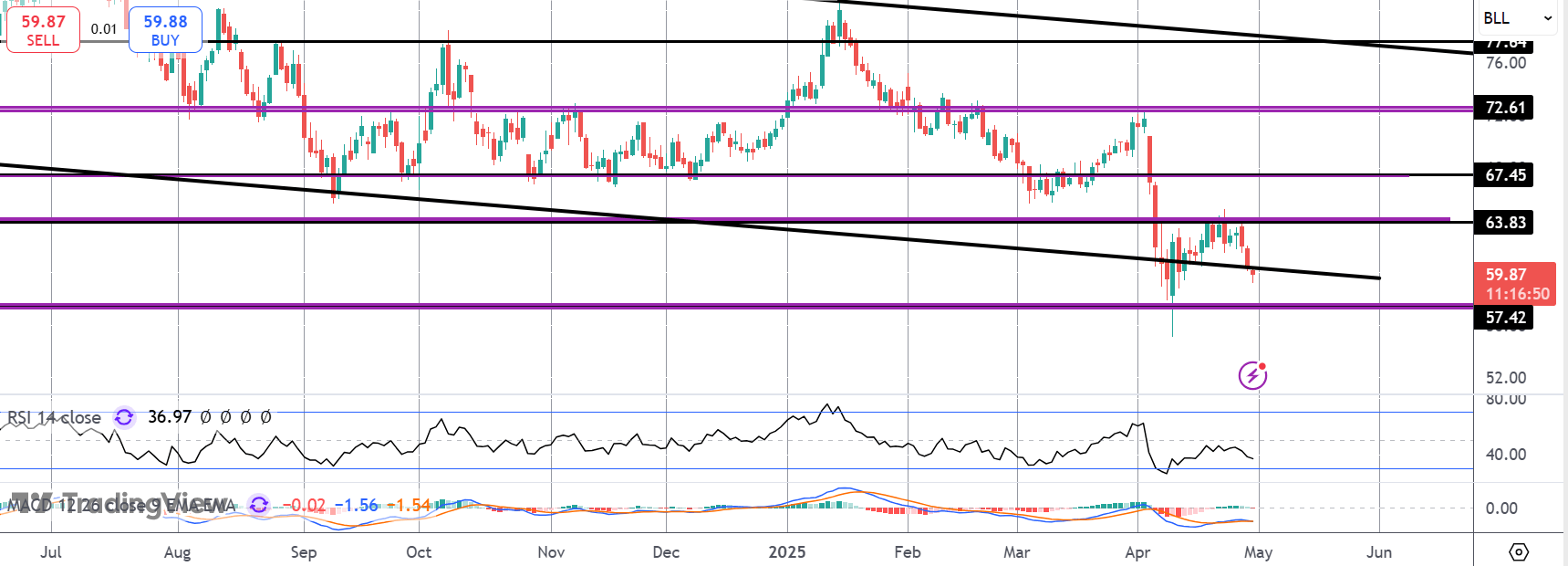

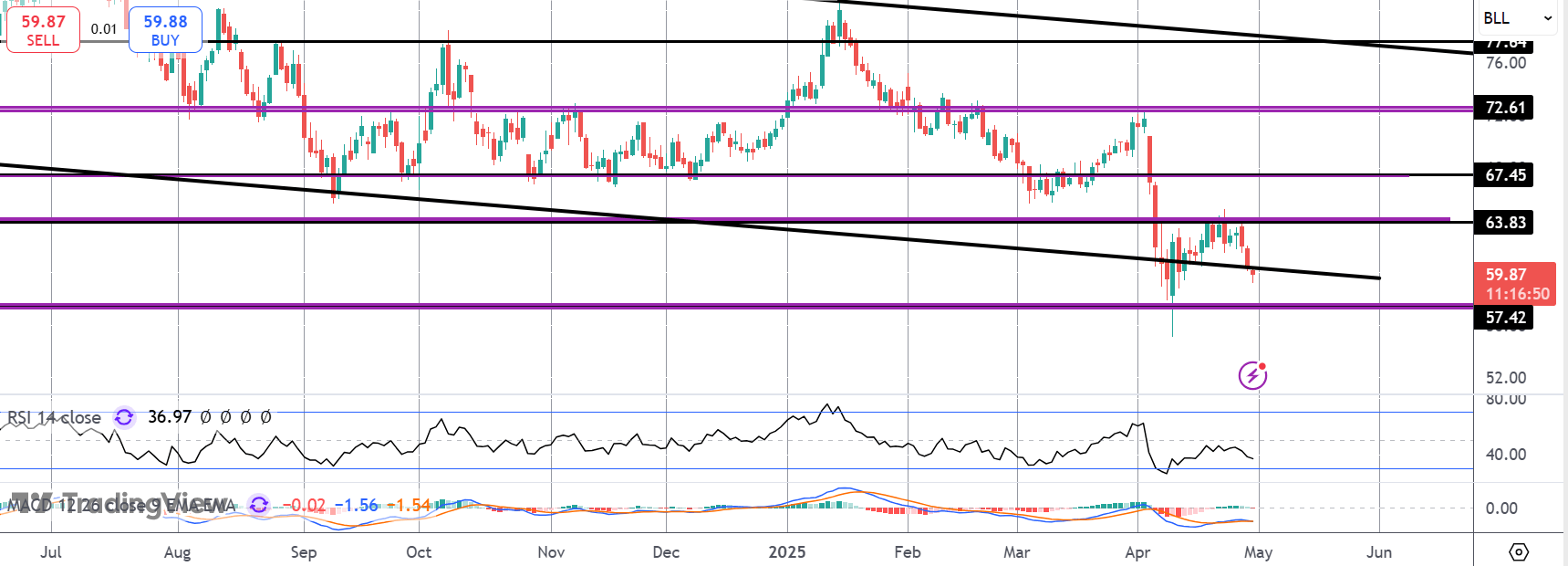

Crude

With the recovery move failing at a retest of the 63.83 level, price is now turning back down towards the 57.42 level which remains the key support to monitor. With momentum studies weakening, bearish risks look to be growing here, putting the YTD lows at risk.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.