Daily Market Outlook, July 14, 2022

Daily Market Outlook, July 14, 2022

Overnight Headlines

- Fed’s Mester Says CPI Data Gives No Reason For Smaller July Hike

- Dollar Resumes Relentless Rise As Inflation Stokes Fed Bets

- Lowest Jobless Rate Since 1974 Sends RBA Rate Bets Soaring

- Singapore Tightens Monetary Policy To Cool Inflation; Q2 GDP Up 4.8%

- Fed's Daly Says Her Most Likely Posture Is 0.75ppt Hike - NYT

- Barkin Says Inflation Fight Must Occupy Fed’s Full Attention

- U.S. Budget Deficit Down Sharply From 2021 As Pandemic Aid Fades

- EU Cuts Euro-Area GDP Forecast, Sees 7.6% Inflation, Draft Shows

- Italy's 5-Star To Snub Key Vote, Pushing Draghi's Govt To The Brink

- Oil Prices Up Ahead Of Potential Large U.S. Rate Hike, Gold Rebounds

- Adeyemo Sees No Need for Secondary Sanctions Over Russia Oil Cap

- Asian Shares Bruised As U.S. Inflation Data Boosts Recession Fear

The Day Ahead

- Equity markets in the Asia-Pacific region are mixed as investors assess the possibility of the Fed raising interest rates even more aggressively than previously expected. Following yesterday’s increase in US headline CPI inflation to a fresh forty-year high of 9.1% and the Bank of Canada’s decision to hike rates by 100bp to 2.5%

- There are no major UK or Eurozone data releases today. The UK RICS housing survey overnight showed the net balance of respondents reporting higher prices moderated to 65% in June from 72% in May. RICS said the market is ‘starting to cool off’ but a lack of stock is keeping prices high. The European Commission will release updated economic forecasts this morning. Reports suggest it will raise this year’s Eurozone inflation forecast to 7.6% from 6.1% and downgrade next year’s GDP growth to 1.4% from 2.3%.

- The afternoon sees the release of US producer price inflation for June and the latest weekly jobless claims data. On the heels of yesterday’s headline CPI inflation, today’s PPI figures are likely to remain elevated, suggesting that there are still substantial cost rises in the pipeline. Meanwhile, initial jobless claims data are expected to reaffirm some cooling of the labour market although it remains very tight.

- Early Friday sees the release of Chinese Q2 GDP which is forecast to weaken because of Covid lockdowns in Shanghai and other cities. Nevertheless, the monthly data for retail sales and industrial production are expected to show recovery through the quarter as curbs were eased. Markets, however, have been concerned about more recent reports of Covid case numbers starting to rise again.

- Markets will be looking ahead to US releases in the rest of Friday, including retail sales, industrial production and the University of Michigan consumer sentiment survey. The remaining Fed speakers will appear before next week’s pre-meeting ‘blackout’ period. Fed Governor Waller will discuss the economic outlook later today.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0000 (234M), 1.0095-00 (854M), 1.0150-60 (968M)

- USD/JPY: 137.50 (340M), 137.75 (350M), 138.00 (365M)

- 139.00 (1.48BLN)

- GBP/USD: 1.1700 (488M), 1.1820 (616M)

- USD/CHF: 0.9735 (250M), 0.9780-90 (910M)

- 0.9825 (380M), 0.9850 (225M). EUR/CHF: 1.0020 (400M)

- AUD/USD: 0.6765 (382M), 0.6865-75 (458M), 0.6890-00 (549M)

- NZD/USD: 0.6090-00 (1.03BLN), 0.6120 (1.33BLN)

- USD/CAD: 1.2925 (420M), 1.2945 (405M)

Technical & Trade Views

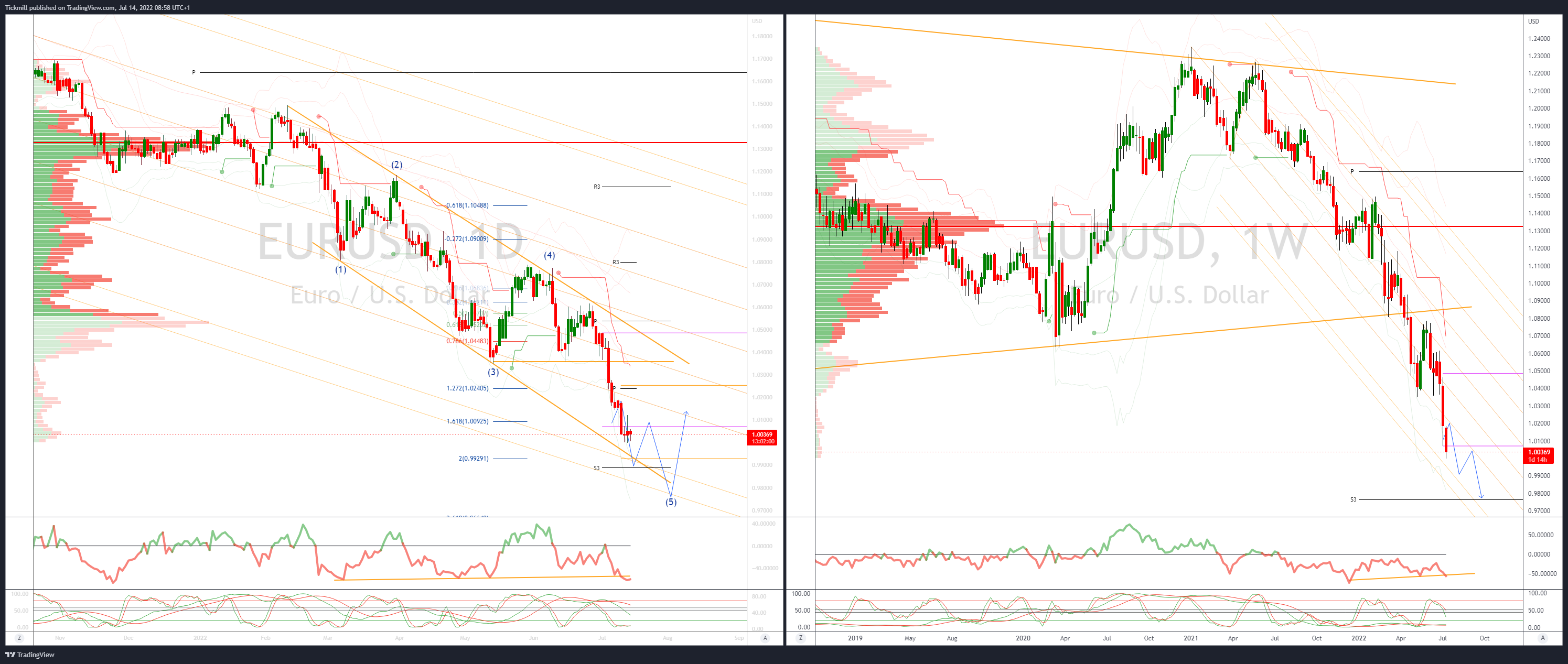

EURUSD Bias: Bearish below 1.0350

- EUR/USD down 0.4%; Bloomberg reports that GDP forecast for Euro-Area slashed

- European Commission cuts 2023 GDP projection to 1.4% from 2.3%-Bloomberg

- Hikes inflation forecast to 7.6% in 2022 from previous 6.1%

- Largest increase in US consumer inflation since 1981 also undermines EUR

- Increased expectations of a 100 bps Fed July rate hike weigh

- Bids eyed below parity .9950 offers sitting above 1.0050

- 20 Day VWAP is bearish, 5 Day bearish

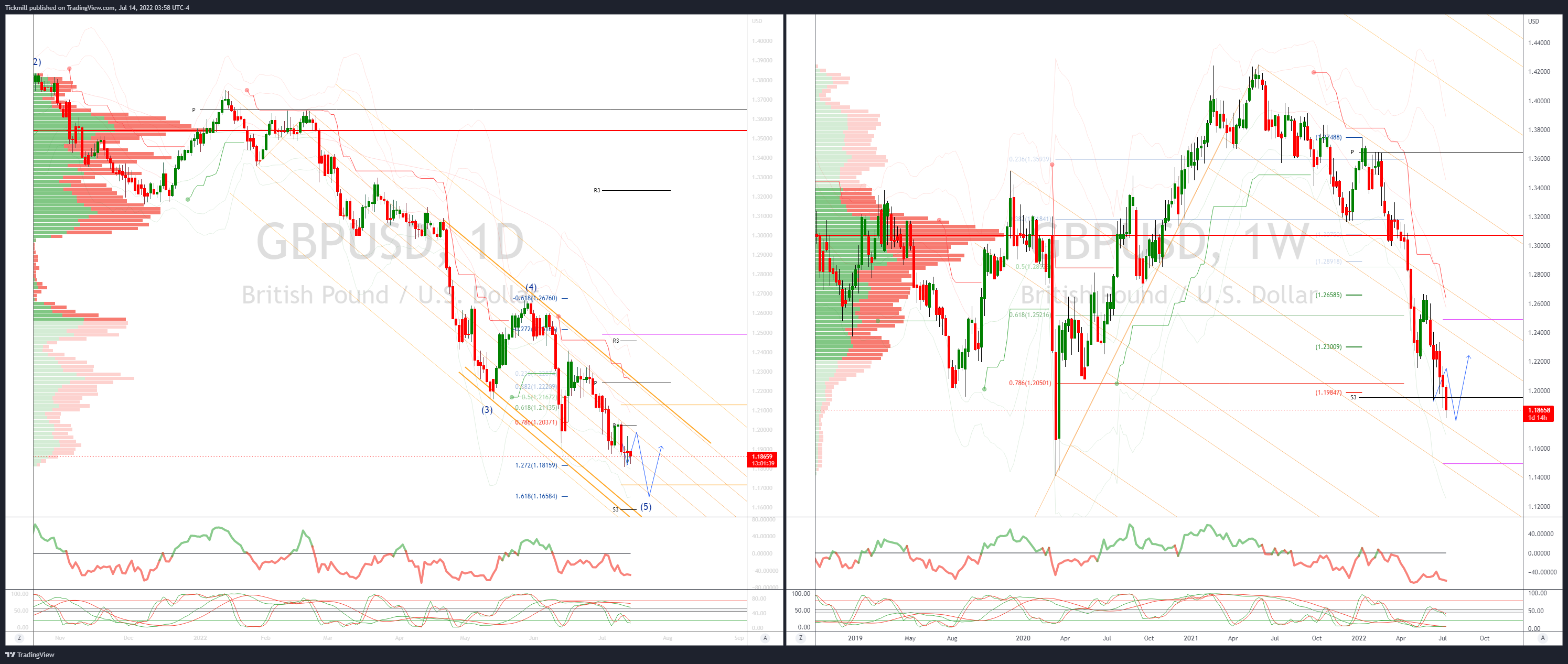

GBPUSD Bias: Bearish below 1.2150

- GBP off lows although upside seems capped by Dollar dominance

- BoE back in the frame after better growth data

- Energy price inflation, recession fears and political unknowns weigh on GBP

- Offers seen at 1.20 Bids 1.1720

- 20 Day VWAP is bearish, 5 Day bearish

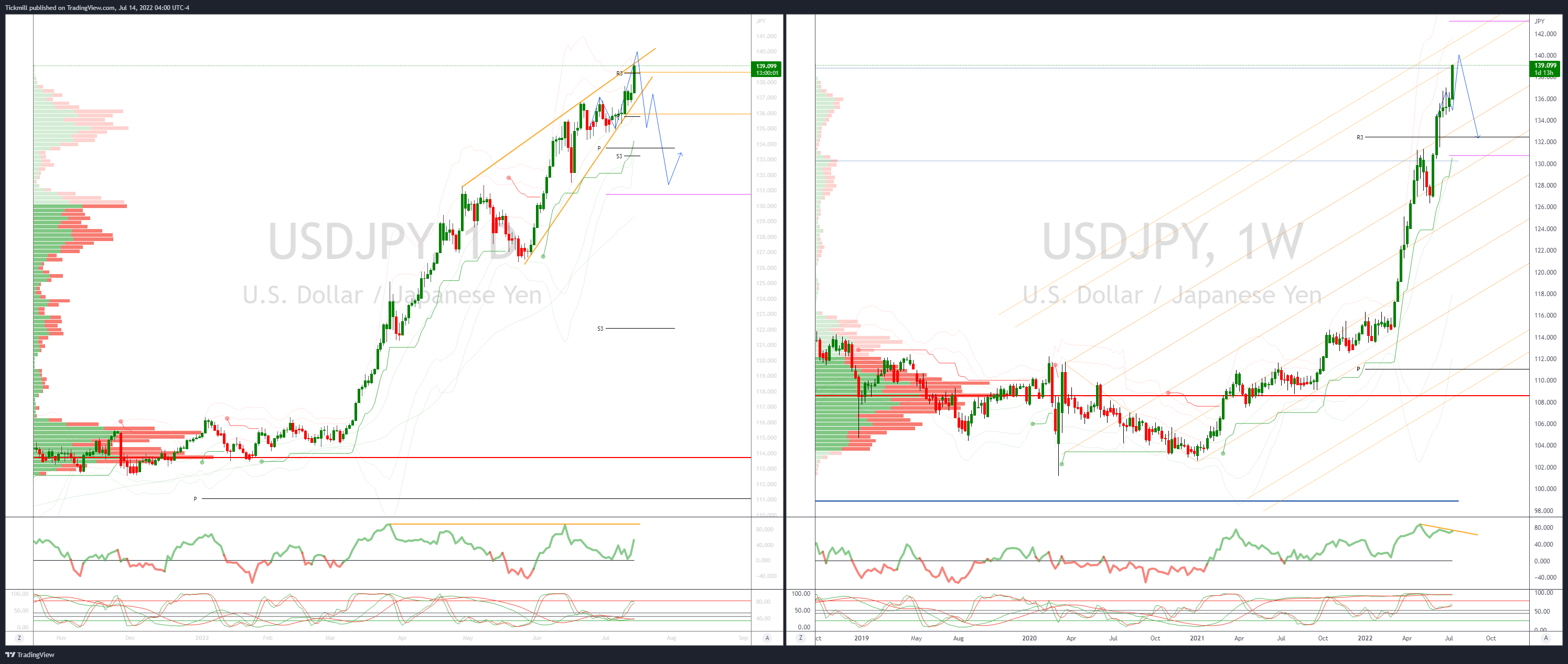

USDJPY Bias: Bullish above 134

- USDJPY bid in Asian session printing highest levels since Sep ‘98

- Supported by hot US inflation and market pricing a historic 100bps rate move

- 1.5Bln of options rolling off at the NY cut today

- Traders see range expansion 135/140

- US10Y trading higher up over 1% on the session

- Offers seen at 139.15 bids 136.75

- 20 Day VWAP is bullish, 5 Day bullish

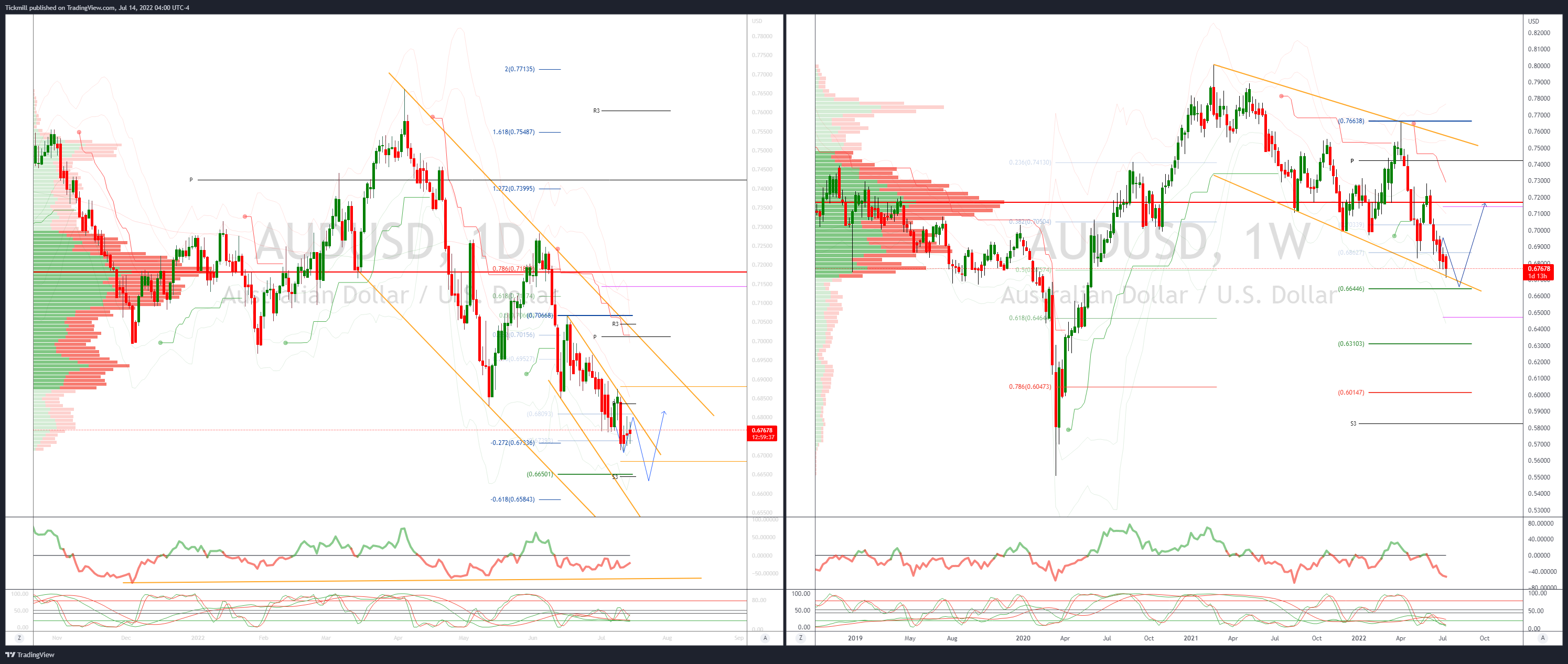

AUDUSD Bias: Bearish below .7050

- AUD recovers post CPI fade on better domestic jobs data

- Australia unemployment dives to 48-year low on jobs boom

- Jobless rate slides to 3.5% from 3.9%, vs.3.8% fcst; lowest since Aug 1974

- Commodity losses, metals meltdown and risk aversion cap upside

- Offers seen at .6830’s with bids tipped at .6685

- 20 Day VWAP remains untested confirming downside

- 20 Day VWAP is bearish, 5 Day bearish

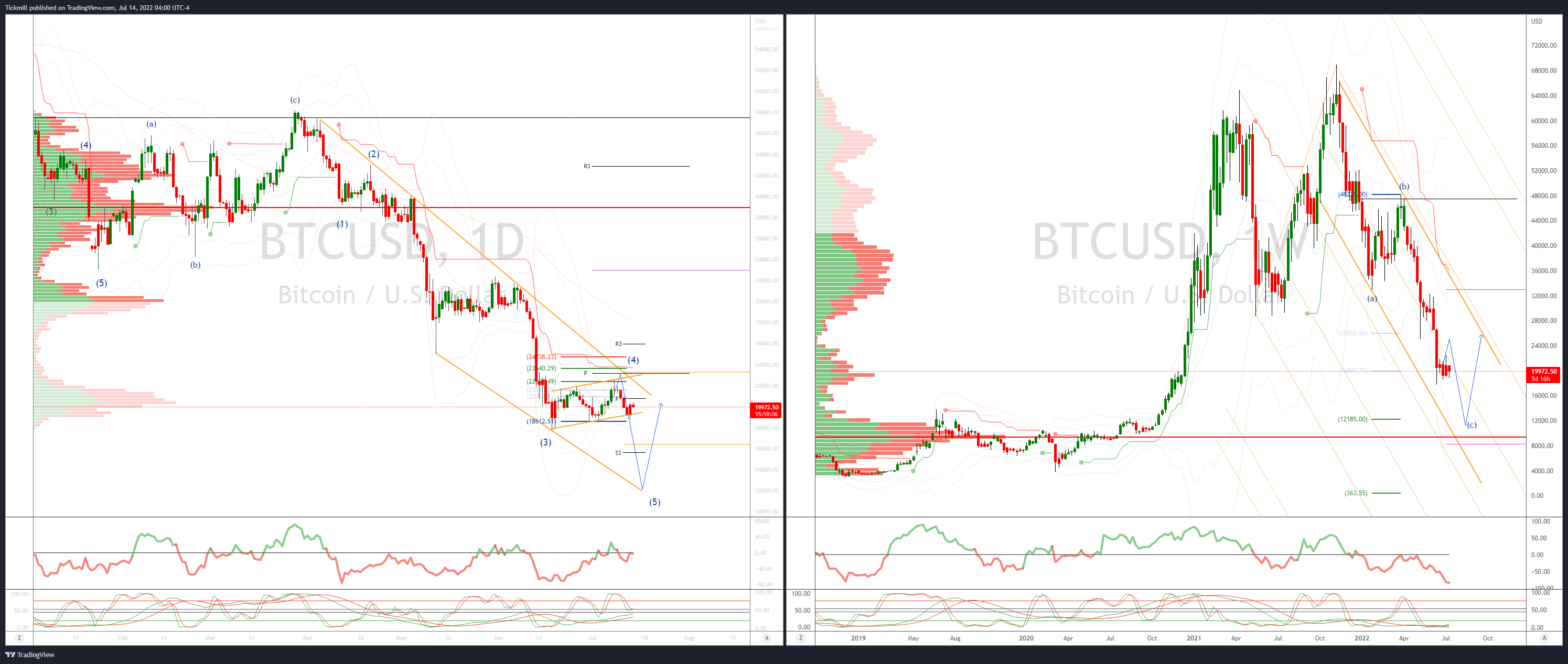

BTCUSD Bias: Bearish below 22k

- BTC recover after testing bids below 19k

- US inflation weighed but reversal from 19k support encourages short covering

- Crypto lender Celsius on bankruptcy watch as market eyes another filing

- 20 VWAP band contracting ready for next directional drive, currently pointing south

- Trend remains down within broader bearish channel

- Support seen at 19k then 18300 the base of the daily VWAP bands failure here opens a retest of lows

- Concerns regarding increasing Crypto scandals and scams leave BTC vulnerable

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bullish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!