Daily Market Outlook, July 25, 2022

Daily Market Outlook, July 25, 2022

Overnight Headlines

- Fed To Implement Second 75bps Rise Amid Uncertainty Over Next Steps

- ECB Holzmann: ECB May Accept ‘Light Recession’ If CPI Outlook Rises

- US Dollar Firm Monday As Fed Meeting And Growth Risks Dominate

- German Industry Cuts Production Due To High Energy Prices - DIHK

- Italy Democrats Weigh Election Alliances, Letta Tells Repubblica

- Janet Yellen Says Signs Of Us Recession Aren’t In Sight For Now

- China Plans To Set Up Real Estate Fund Worth Up To $44 Bln

- Aus PM Albanese Calls for China to End Trade Sanctions on Australia

- PBoC Official Vows to Protect User Privacy in Digital Yuan Push

- Japan Yield Drops To Four-Month Low On Global Slowdown Fears

- Oil Falls On Concerns Expected Fed Hike Will Impact Fuel Demand

- Asian Shares Start Week Lower, Tracking Wall St Retreat Ahead Of Fed

- China Plans Three-Tier Data Strategy To Avoid U.S Delisting’s

- Credit Suisse Mulls Job Cuts As Losses Rise - Sonntagszeitung

- Boeing Union Workers Reject Contract Offer, Call For Strike - RTRS

The Day Ahead

- Most Asia equity markets are trading lower this morning on concerns about the global economic outlook. One driver may be last Friday’s surprising plunge in the US services PMI survey to 47.0 from 52.7 which triggered a drop in 10-year Treasury yields below 2.75%. US Treasury Secretary and former Fed Chair Yellen, however, said that she does not see a broad recession due to the strong labour market even if this Thursday’s Q2 GDP is negative for a second successive quarter.

- The UK calendar is light on official data this week. The monthly CBI industrial survey for July is scheduled to be released this morning. The report will provide the usual update on orders, output and selling prices. Last month showed moderation in total orders and expected output, and there was a notable easing in the net balance for selling prices, although it remains high relative to pre-Covid levels. Today’s report will also contain more detailed quarterly results, and possibly of most interest will be the extent to which investment intentions are holding up. The last set of quarterly questions in April showed the weakest investment intentions since early 2021. In politics, the two remaining candidates in the Conservative leadership contest to be next PM, Rishi Sunak and Liz Truss, will face each other in a televised debate later today.

- The German IFO survey will be closely watched as usual for the latest gauge of business sentiment in the Eurozone’s biggest economy. Last month’s headline business climate index fall was led by a particularly large drop in the forward-looking expectations component. Look for the headline index to decline further in July to 90.0 from 92.3, which would be a two-year low reflecting big concerns about energy supply and security. Also look for falls in both the current assessment index to 97.0 (from 99.3) and the expectations index to 83.0 (from 85.8).

- In the US, the Dallas Fed’s regional manufacturing survey and the Chicago Fed’s national activity index will come out. They normally attract limited attention, and more important data releases are due later this week, but markets will be looking for further signs of economic slowdown.

- Overnight, the minutes of the Bank of Japan’s June meeting will be released. The BoJ stands out as the only G7 central bank to keep interest rates at ultra-low levels. It will be interesting to see if there are any signs of pressure on the BoJ to alter its stance as inflation creeps higher. Policymakers, though, are more likely to maintain current policy settings given that evidence appears to show domestic price pressures remaining subdued.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0200 (646M), 1.0250 (1.86B), 1.0300 (406M)

- GBP/USD: 1.2010 (575M), 1.2050-55 (447M). EUR/GBP: 0.8550 (431M)

- AUD/USD: 0.6750 (1.09B), 0.6895-05 (587M), 0.6925 (453M), 0.6950-55 (915M)

- AUD/USD: 0.7000 (1.07B). NZD/USD: 0.6100 (653M), 0.6300 (476M)

- USD/CAD: 1.3010 (700M), 1.3100 (553M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.0350

- EUR/USD under pressure in Asia as USD bids emerge

- EUR/USD has traded as low as 1.0180 after trading 1.0220 earlier

- A break below 1.0130 would encourage bears again

- Mood in Asia is cautious with e-minis and AXJ index down 0.25%

- Resistance 1.0250/60, support 1.0100-05, 1.0070-75

- Price testing the 20 Day Bearish VWAP

- 20 Day VWAP is bearish, 5 Day bearish

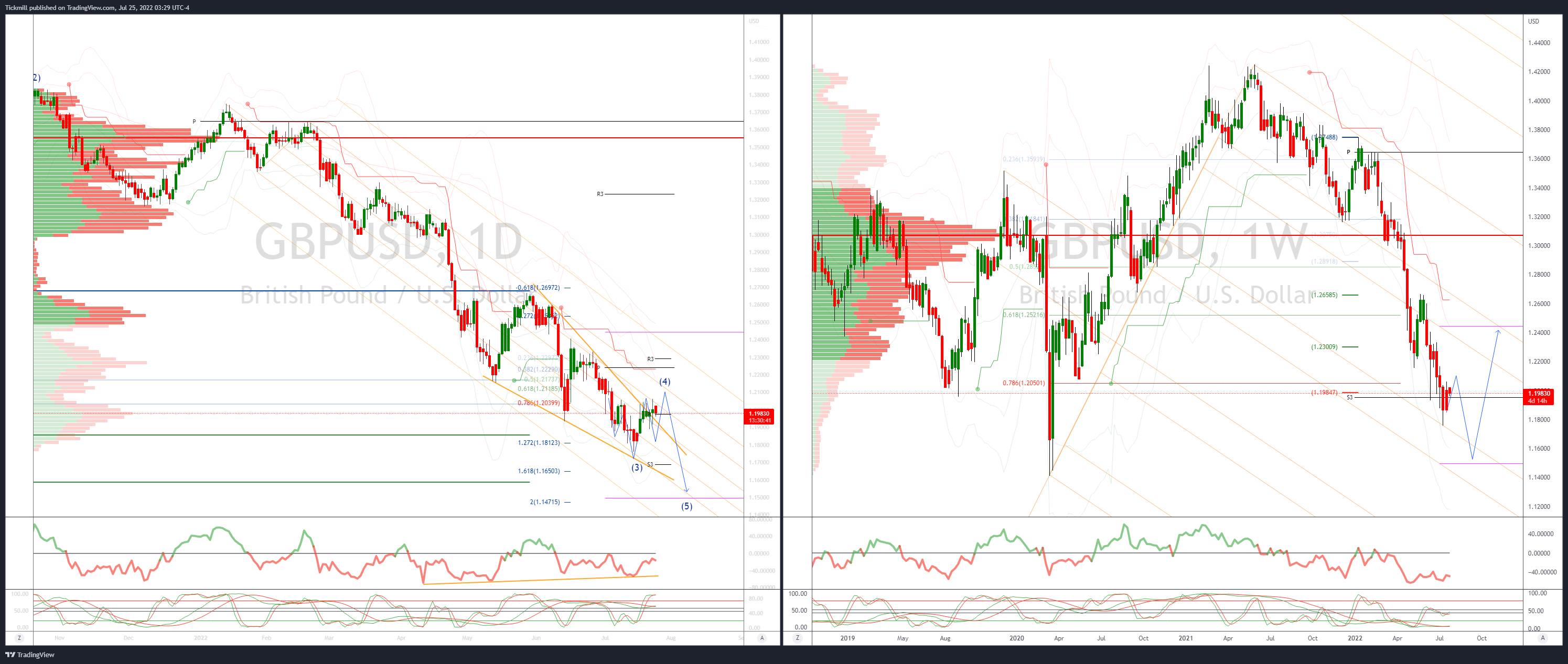

GBPUSD Bias: Bearish below 1.2150

- Summer doldrums trade in GBP Asia session, limited directional flows

- Cable coming under pressure as LDN comes in lack of liquidity

- Some option expiries above today - 1.2010 GBP566 mln, 1.2050-55 446 mln

- Sunak and Truss TV debate eyed later

- Offers sited at 1.2050 bids 1.1890

- 20 Day VWAP is bearish, 5 Day bearish

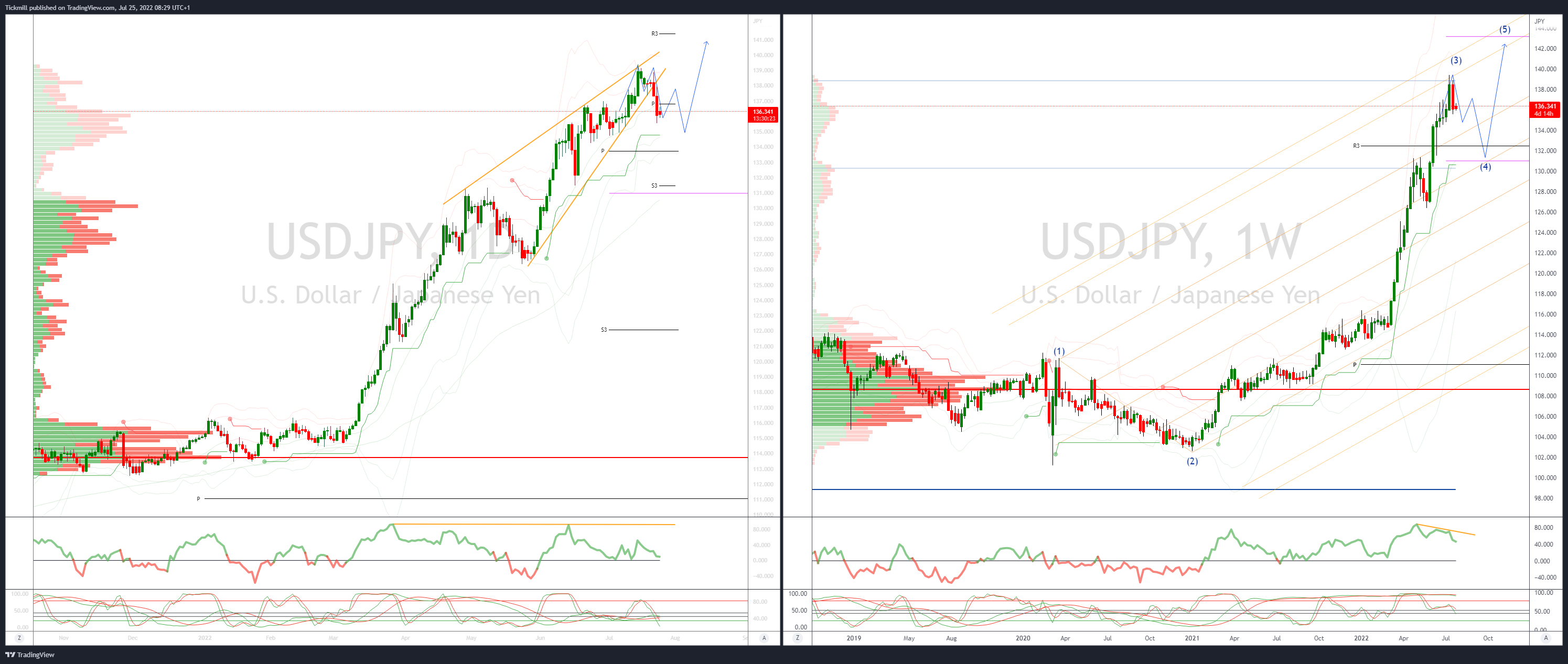

USDJPY Bias: Bullish above 134

- Good Japanese and spec buying of USD/JPY from the get go in Asia

- USD/JPY as low as 135.58 EBS Friday, Asia today 136.12 to 136.58

- Thinner, summer holiday-affected markets leading to larger swings

- Japanese importers amongst those buying large, still dip-buyers

- Other interest also noted including some investors, on carry interest

- Offers sited 137.30/50 bids at 135.10

- 20 Day VWAP is bullish, 5 Day bullish

AUDUSD Bias: Bearish below .7050

- Recovering from pressure early Asia as USD firms to start the week

- AUD/USD testing 0.6900 as USD moves higher across the board

- The 10-year US yield is up 3 BPs to 2.787% and underpinning USD

- E-mini futures weakening and likely to weigh on AUD

- AUD/USD support is at Friday's 0.6876 low and break targets 0.6840/45

- 20 Day VWAP is bullish, 5 Day bullish

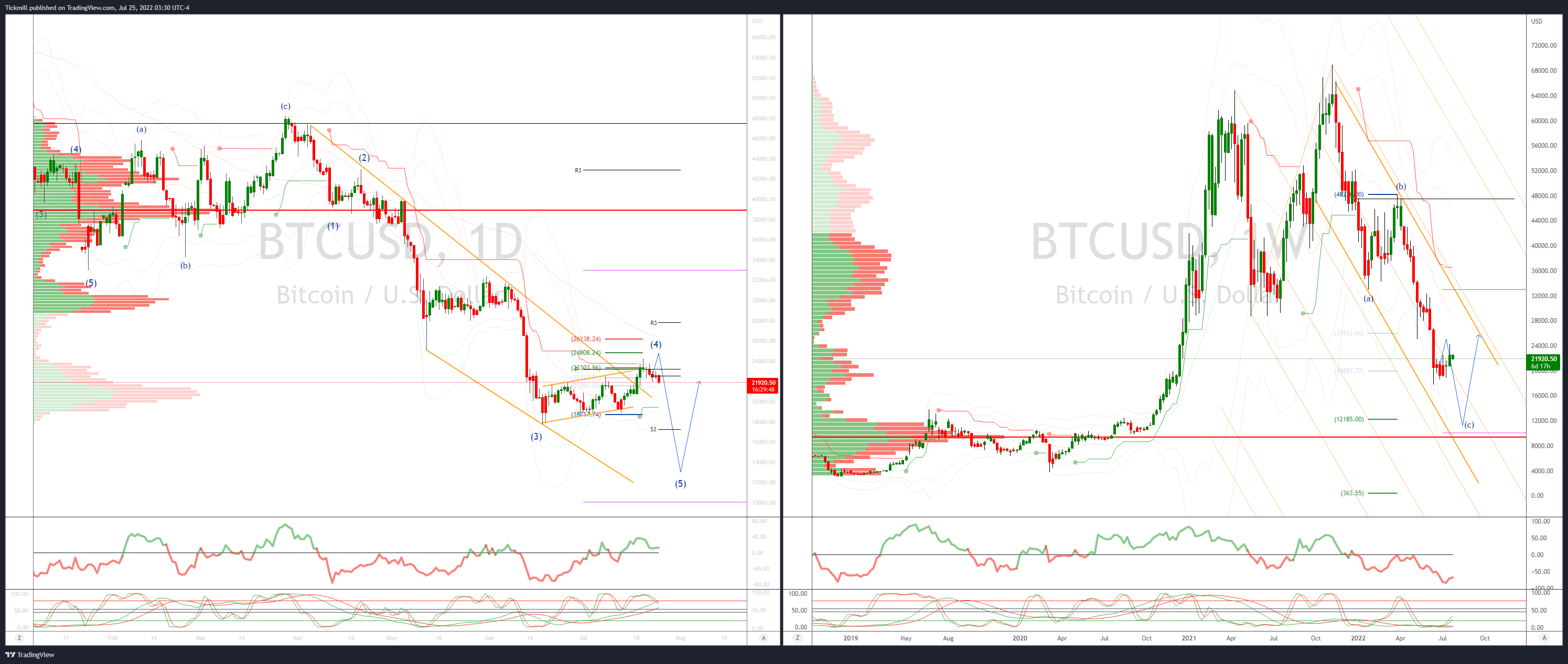

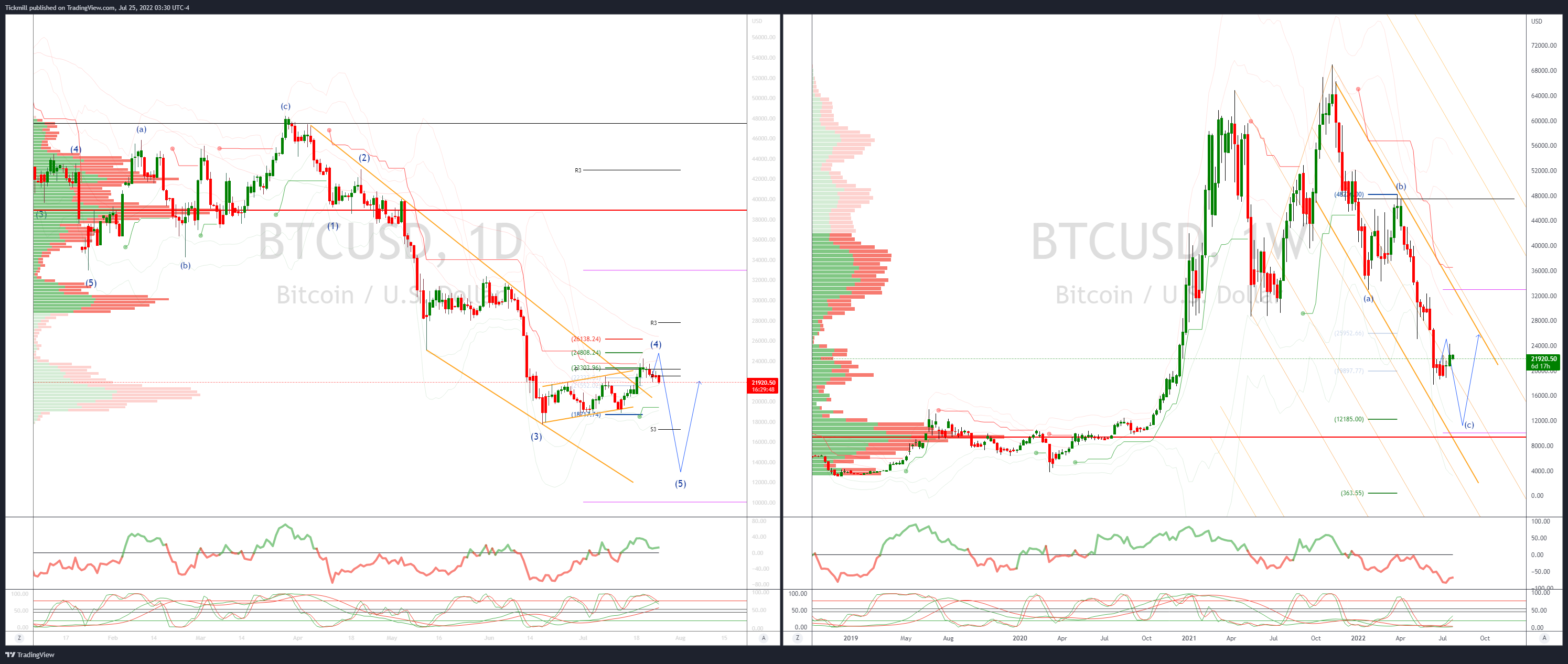

BTCUSD Bias: Bearish above 22k

- BTC slides 3.2% below 22k, threatening deeper drop

- Falls out of VWAP uptrend channel

- Closing below 22k will dampen BTC in near term

- If below 20.5k, downtrend channel back in play

- Risk appetite fragile leading up to Wed FOMC decision

- Possibility of jumbo 100bps hike can't be ruled out

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!