Dollar Plunges As Fed Rate-Cut Bets Soar

DXY under Pressure

The US Dollar is in free fall this week as ballooning US economic risks fuel a sharp rise in near-term Fed easing expectations. Comments from President Trump this week, refusing to rule out a recession this year and warning that the US economy is in a period of transition, have sparked a selling frenzy. Alongside the landslide we’re seeing in stock prices this week, the US Dollar has also been heavily sold as US treasury yields plummet. Trump’s comments on the economy mark a concerning shift from his campaign promises that tax cuts and tariffs would fuel US economic growth.

NFPs Drop

His warnings come just days after a disappointing set of US labour market readings last week. US wages growth was seen cooling to 0.3% from 0.5% prior, the unemployment rate rose to 4.1% from 4% prior while the headline NFP printed 151k below the 159k the market was looking for. Additionally, the prior month saw a heavy downward revision to 125k from 183k prior.

Fed Easing & US Inflation

With near-term Fed easing expectations spiking in the last week (May now 50/50 and June priced as a cut), the US Dollar continues to slide. The DXY is down almost 4% this month and is lower by almost 7% from the YTD highs. Traders now turn their focus to tomorrow’s US inflation readings with annualised CPI forecast to cool to 2.9% from 3% prior. If confirmed at this level, or lower, DXY looks likely to continue lower near-term as Fed easing expectations move up again. The deeper the undershoot tomorrow the more aggressive the downside reaction in DXY. Given the backdrop, it would take a strong upside surprise to stem the selling this week.

Technical Views

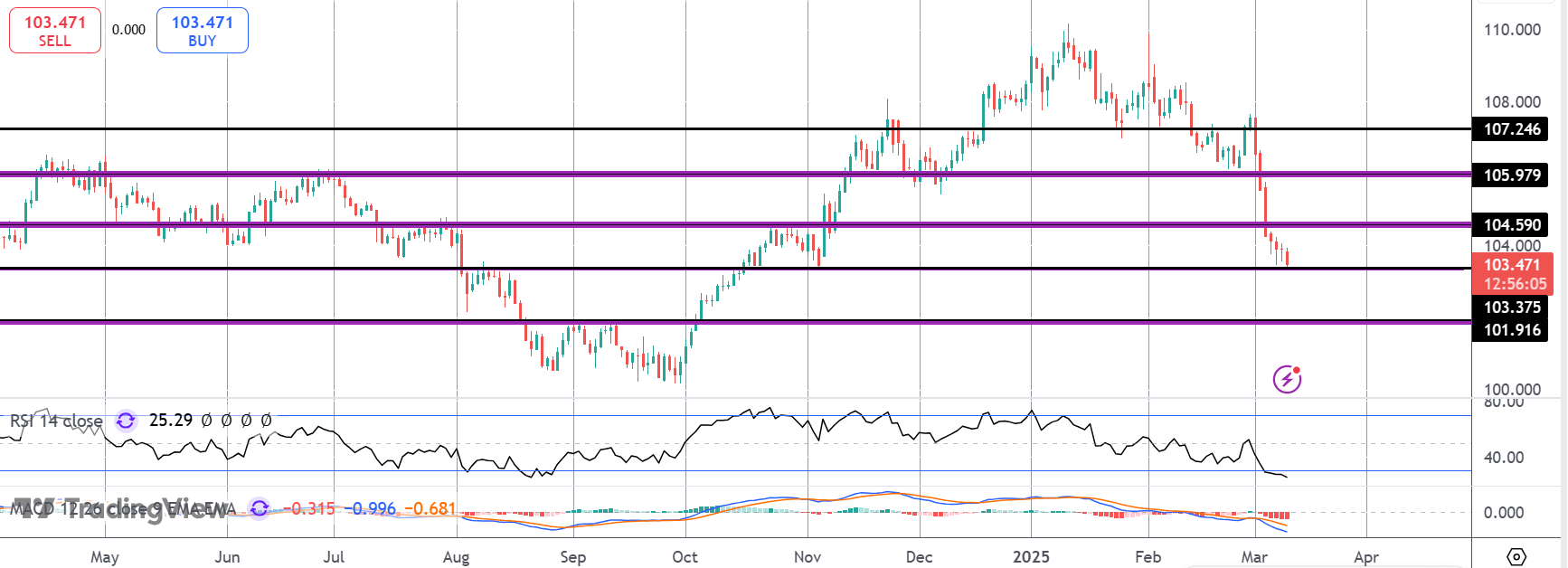

DXY

The sell-off in DXY has seen the market breaking below two big levels recently. Price is now testing the 103.37 level. If we break below here, focus turns to a test of deeper support at the 101.91 level, in line with bearish momentum studies readings. Bulls need to get back above 104.59 near-term to alleviate bearish risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.