EURJPY Breaking Out on BOJ Comments

JPY Falling Further

The Japanese Yen is weakening across early trading on Monday following the latest comments from BOJ governor Ueda today. Speaking a few hours ago, Ueda signalled that the prospect of negative rates being reversed this year was very low. While Ueda acknowledged that the bank had made progress in terms of bringing inflation sustainably to target, the BOJ chief noted that there was still a great deal of uncertainty in the outlook which means that monetary policy will stay as it is for now.

Wage – Price Cycle Key for BOJ

The key issue for the BOJ currently is determining whether a wage-price cycle will kick in to keep inflation supported. While Ueda noted that some positive developments had been made, he shared the concern of some at the BOJ that wage increases are typically harder to pass on to consumers than other increases such as raw materials costs.

2024 JPY Bullish Risks

For now, JPY looks prone to further weakness. However, looking through year end, bullish risks look to be building. The BOJ recently adjusted its inflation forecasts firmly higher for the next fiscal year with CPI expected to hit 2.8%. As such, market pricing is now projecting a BOJ hike in H1 which should fuel a heavy bullish reversal in JPY.

Technical Views

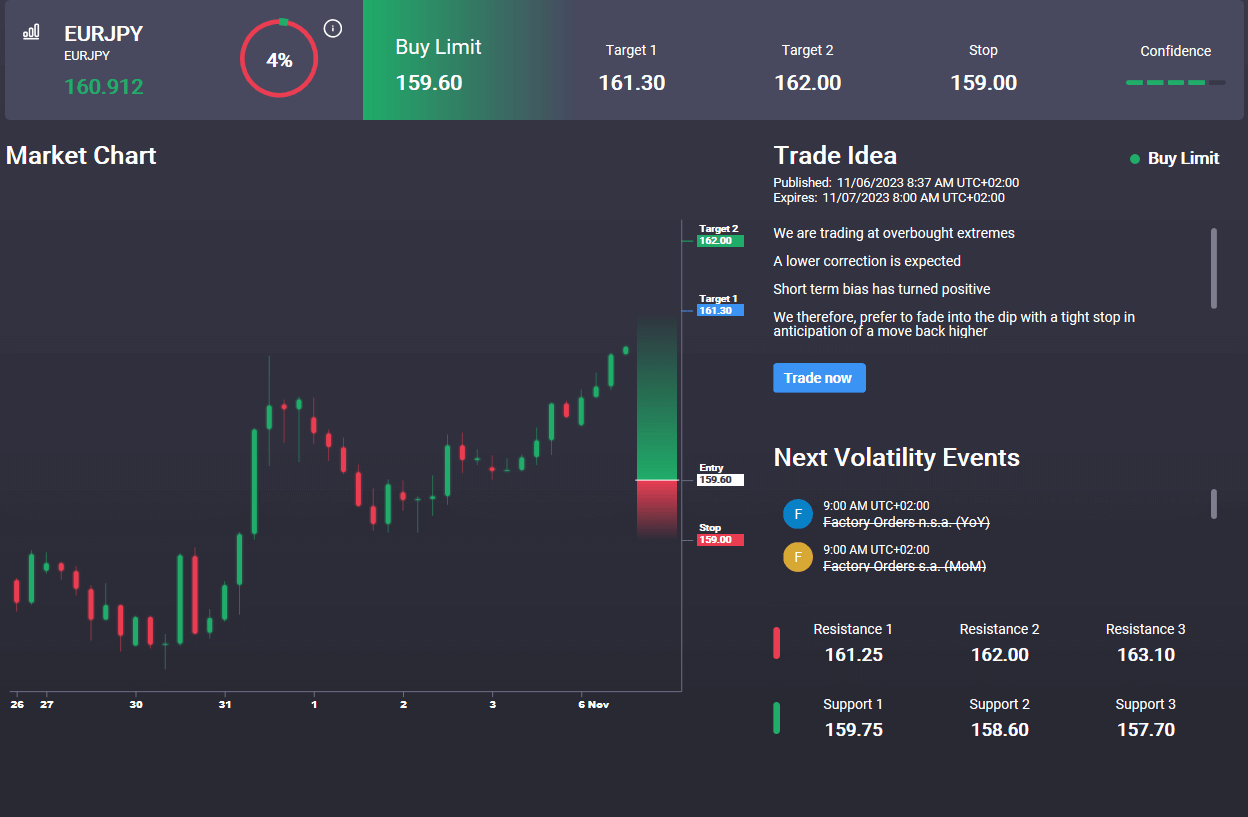

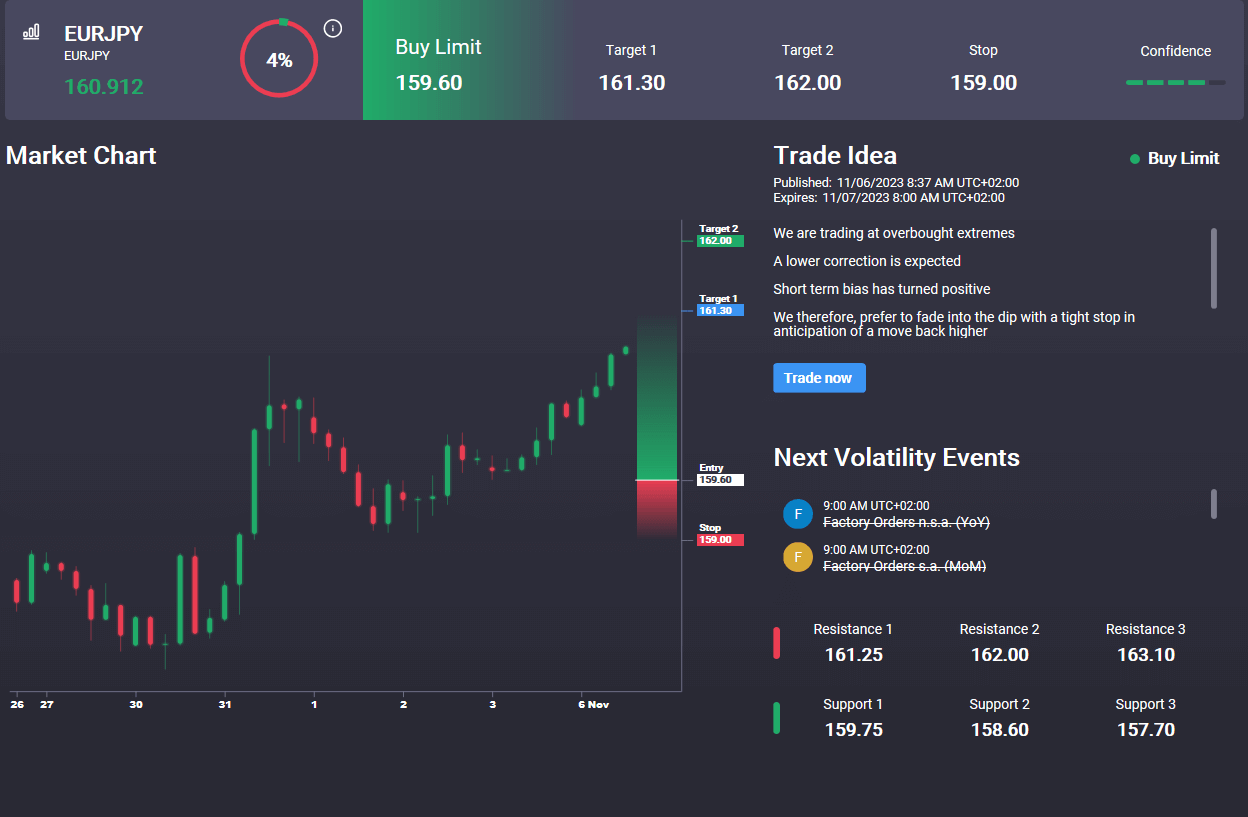

EURJPY

The rally in EURJPY has seen the market trading up to test the underside of the broken bull channel. With momentum studies bullish, the focus is on a continuation higher while price holds above 159.71, targeting a challenge of the 162.29 level next. To the downside, 155.40 remains key support to watch. Notably, we have an active buy signal in the Signal Centre today, set below market at 159.60, reflecting a preference to buy dips.

-1699264002.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.