Euro and Pound Strengthen Amid Shifting Central Bank Expectations and Mixed Economic Signals

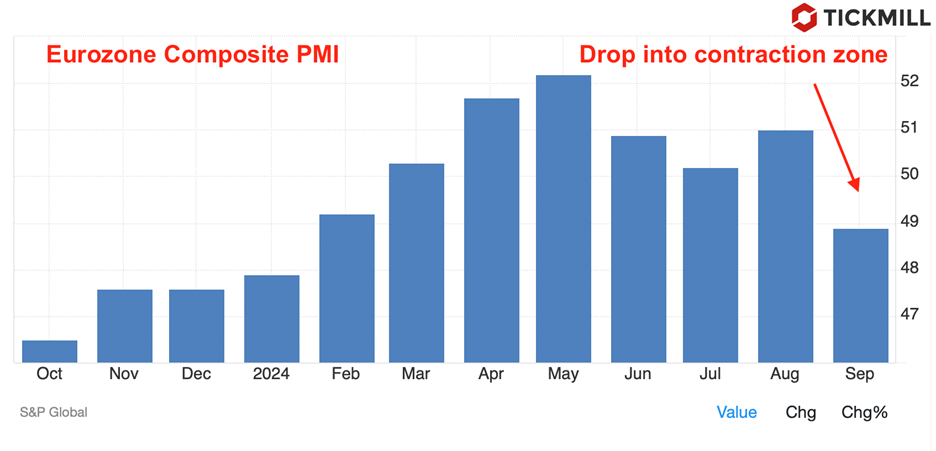

Despite the Eurozone's latest flash PMI data pointing towards a contraction, the EUR/USD pair has shown surprising strength. The Composite PMI slipped to 49.8 in September, falling below the critical 50.0 mark that delineates expansion from contraction. This decline was primarily driven by the manufacturing sector, which saw its PMI drop to 46.2, indicating an accelerated slowdown. The services sector, while still expanding, registered a slower pace with a PMI of 52.0, missing economists' forecasts:

Technical picture of EURUSD:

Market participants are speculating that the ECB may proceed with another interest rate cut in its October meeting to bolster the slowing economy. However, persistent inflation remains a thorny issue. ECB Governing Council Member Isabel Schnabel recently highlighted concerns over stubbornly high services inflation, which continues to keep the headline inflation rate elevated. This inflationary pressure complicates the ECB's policy decisions, as cutting rates might further fuel price increases.

On the other side of the Atlantic, the US dollar is grappling with its own set of challenges. The S&P Global Composite PMI for the US edged down to 54.4 in September from 54.6 in August. The manufacturing sector's performance was disappointing, with the PMI slipping to 47.9, signaling a deeper contraction than expected. The services sector, although still robust, saw its PMI decrease to 55.4 from 55.7.

Adding to the dollar's woes is the looming shadow of the upcoming presidential election. Business sentiment has taken a hit, with companies reporting subdued demand, hiring, and investment due to political uncertainty. Traders are now increasingly betting on the Federal Reserve implementing another 50 bp interest rate cut in its November meeting, following a similar cut previously. Concerns over weakening job growth and a cooling economy are fueling these expectations.

The British Pound has been on an upward trajectory, strengthening against both the Euro and the Dollar. Investors are projecting that the BoE policy easing might be less aggressive compared to other G7 central banks. High inflation in the UK's services sector—running hotter than in many other economies—is a significant factor. Markets anticipate that the BoE might implement one more rate cut this year, likely in one of its two remaining policy meetings. The expectation is that the BoE will tread cautiously, balancing the need to support growth without exacerbating inflation.

Technical picture of GBPUSD:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.