FTSE Falls With UK Elections Looming

Election Impact

The FTSE remains under steady selling pressure today with the index falling to fresh 2-month lows ahead of Thursday’s UK general election. The core expectation is that the Conservative Party will lose power with the Labour Party taking over. Given the party’s traditional perception as being more anti-business than the Conservatives, stock traders are showing some hesitancy ahead of the expected changeover in power later this week.

Market Reaction

Typically, the FTSE trades lower ahead of general elections before rallying once a decision is made. In the event of a Labour win, upside will likely be more muted. If we see Labour having to share power with another party, this should see a more stable reaction given the greater difficulty for Labour to change policy. Finally, if we see the Conservatives retain power (very unlikely at this stage), this should see a strong rally in the FTSE.

Global Election Uncertainty

Alongside the UK elections, the results of the first round of the French elections have also caused uncertainty, pointing to strong support for the far-right. With over 80 countries due to vote this year, including the US in November, there is a growing feeling of uncertainty. The risk of policy changes and the impact on global trade is likely to be a key headwind for companies in coming months.

Bullish BOE Impact

While stocks might find some continued near-term selling pressure, the broader picture should be bullish. The BOE is still widely expected to press ahead with rate cuts this year, in line with inflation falling back to target. Indeed, should inflation continue to move lower, we could still see a series of cuts from the BOE this year which should help drive demand for stocks later in the year.

Technical Views

FTSE

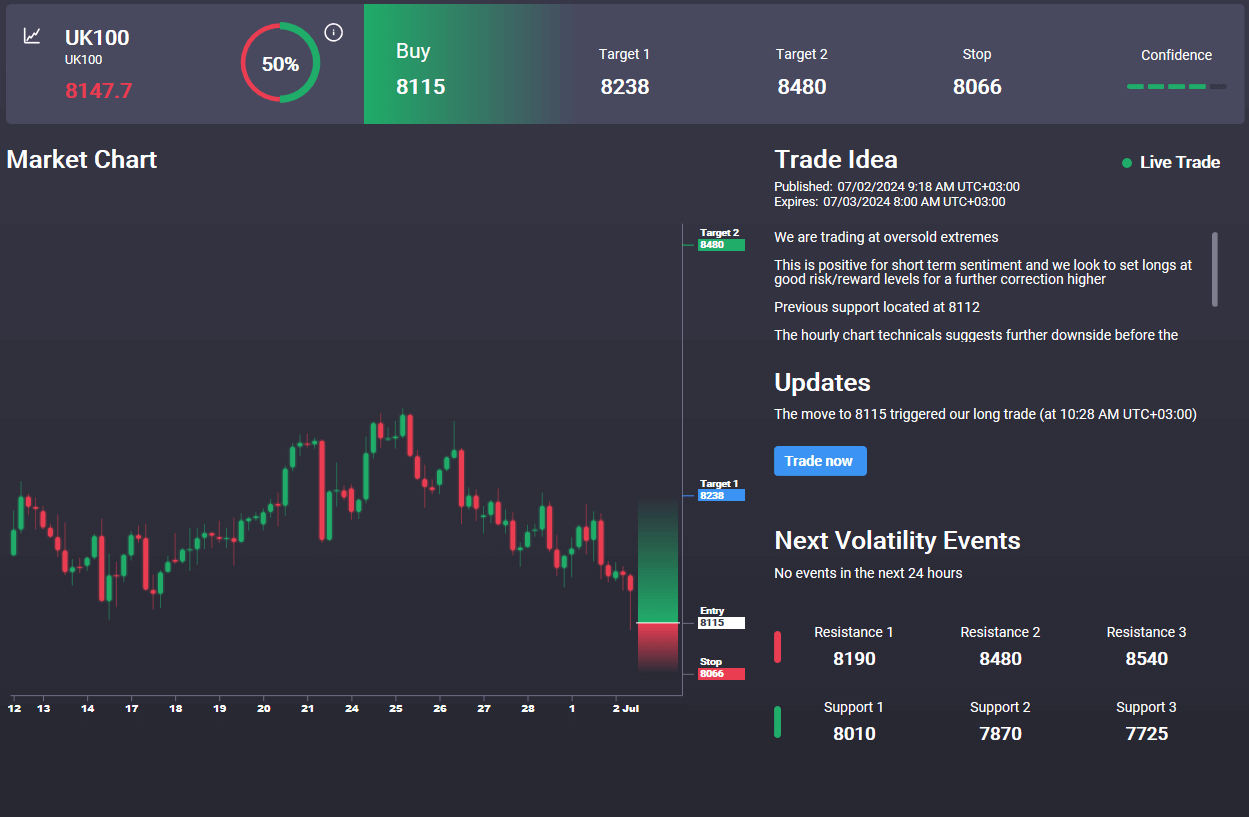

The latest test of the 8,331.6 level has seen the market turning lower again. Price is now testing the bull channel lows and retesting the broken bear channel highs, with structural support just below at 8,023.5. This is a major support area for the market. Should we break below, 7,811 sits as the deeper target for bears. In the Signal Centre today we have a an active buy at 8115 targeting a move back up into mid 82's.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.