Institutional Insights: Goldman Sachs, The Hunt For Red October

.jpeg)

Institutional Insights: Goldman Sachs, The Hunt For Red October

Below are the observations of Goldman Sachs Head of Equities Trading In The US

"I am bullish on US equities for a year-end rally starting on October 28th. I am worried that my 6K target is too low.

I am tactically bearish on US equities over the next 3 weeks. I am bracing for added volatility and the market to over-trade daily headlines and themes

There is a supply and demand mismatch, and skew is to the downside. The market now has the ability to move more freely. Index gamma declined by - $14 billion, which is the largest change in our dataset.

Everyone is in the pool. Systematic exposure is long, corporates are in their blackout window, institutional investors have been forced in, HFs need to take down exposure given elevated election volatility, and mutual fund yearend is on Halloween (spooky)?

I am bullish on Chinese equities, this time is different. I have never seen this much daily demand for Chinese equities: I do not even think we have gone back to benchmark index weights yet

Index Gamma – we saw the largest decline in S&P 500 Index Gamma on our record. This means that the market has more of an ability to move freely. I think the market moves to the downside.

Equity CTA demand has run out of ammo and is now skewed asymmetrically to the downside as systematic strategies are full. As of yesterday (this will look different today) Over the next 1 month… a. Flat tape: Buyers $12.13B ($0.38B out the US) b. Up tape: Buyers $27.41B ($0.73B into the US) c. Down tape: Sellers $144.83B ($49.92B out the US)

Volatility target/control strategies no longer have room to add exposure with VIX $19.62 and into the election. Volatility is no longer the coach on the sidelines: it is the player on the field

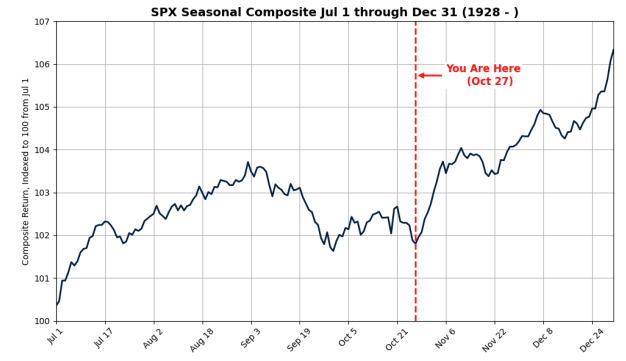

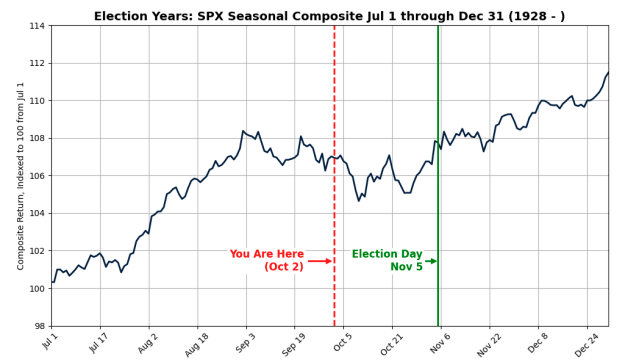

Q4 Seasonals (SPX / NDX / RTY) start to bounce in on October 27th. After pulling in 100 years of data for the S&P and the start of other US indices, this day is important....

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!