Institutional Insights - Goldman Sachs VIX View

Institutional Insights - Goldman Sachs VIX Views

According to Goldman Sachs last week the 'the US volatility market flinched … its up to trading desks to decide if this was an overshoot

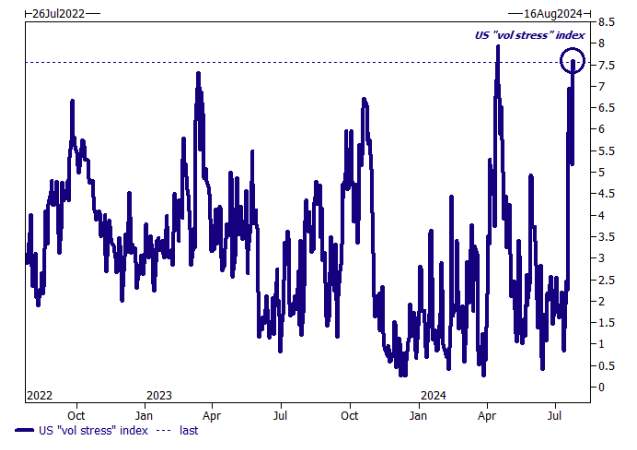

1/ gs has an index which monitors 4 different aspects of “vol stress” … it hit a ~2 year high last night

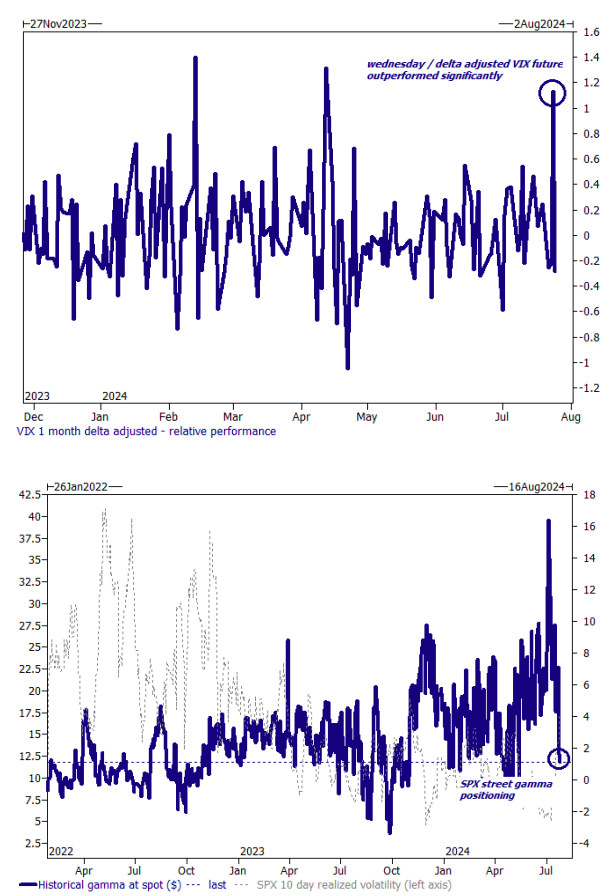

2/ gs has a calculation which monitors the modeled 1 day move in VIX relative to the realized move in VIX … that ratio hit was ~2y high on Wednesday

3/ gs has a calculation for SPX street modelled gamma positioning … that hit a year to date low this morning

4/ gs vol desk frequently monitors cash vs option volumes … option volumes are trading all time highs (~52mm contracts per day for the last two weeks) vs cash volumes muted. Next week is arguably the busiest week of the summer … massive macro events (JOLTs, BOJ, Euro CPI, US ECI, FOMC, BOE, NFP) coupled with massive earnings announcements (40% of SPX market cap next week) … the cost of the 1 week straddle has more than doubled from ~0.9% start of July to almost 2% today hedging toolkit for those inclined ... "hedging late summer risk" for those inclined … from the cross asset seat, i would argue hedge budget could be better served in the credit market, as this “flinch” is currently and equity-only phenomenon.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!