The FTSE Finish Line - July 03 - 2023

The FTSE Finish Line - July 03 - 2023

AstraZeneca Losses Leave The FTSE In The Red To Start July

Despite reaching record highs earlier this year, the UK's FTSE 100 experienced a decline in the April-June period due to volatile commodity prices and persistent inflation concerns, which led to expectations of further monetary policy tightening. Monday morning saw the FTSE 100 rise supported by shares in mining stocks which benefited from higher metal prices, while Chinese-exposed companies were bolstered by hopes of additional policy support from Beijing. Industrial metal miners led the gains with a 2.3% increase, supported by the rise in base metal prices and improved market sentiment. Anglo American,saw its shares rise by 4.3% and emerged as the top gainer on the FTSE 100. This positive movement was attributed to the company's subsidiary, De Beers Group, reaching a new diamond sales agreement with the Botswana government.

The early gains in the blue chip index reversed thai afternoon as shares of AstraZeneca, a leading pharmaceutical company and FTSE heavyweight, have fallen by 7.4% after the company announced that an experimental precision drug, developed jointly with Daiichi Sankyo of Japan, showed slower progression of lung cancer in a late-stage trial. However, analysts have expressed concerns that the benefits of the drug may not be as significant as anticipated. AstraZeneca reported "some" fatal adverse events during the trial, which has raised additional concerns. Jefferies, the brokerage firm, noted limited details and the occurrence of related deaths as issues for AstraZeneca. The London-listed shares of AstraZeneca are on track to record their worst day since November 12, 2021, and the shares hit their lowest level since March 22. Prior to this decline, the London-listed shares had been down approximately 2% year-to-date, while the U.S.-listed shares had experienced an increase of around 3% in the same period.

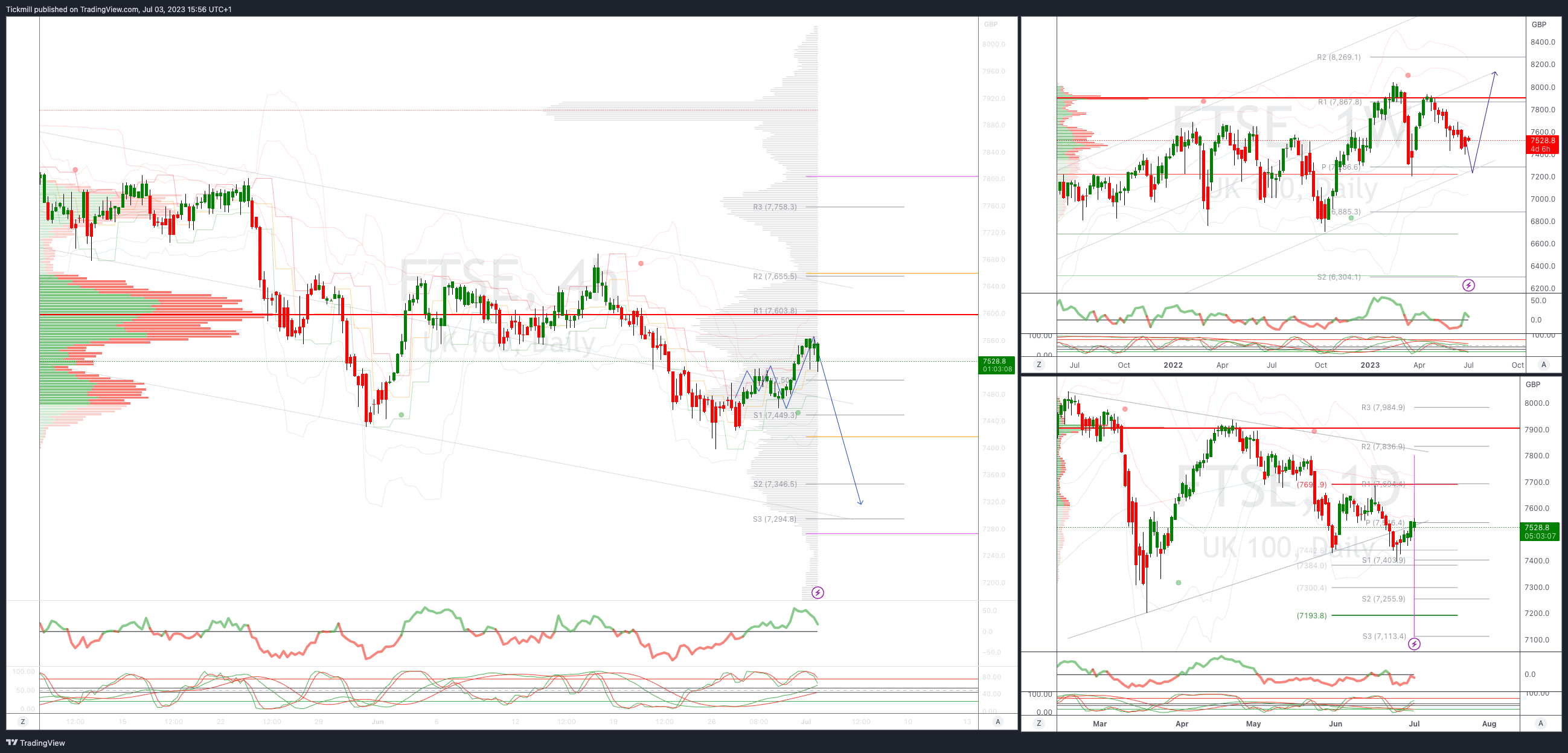

FTSE Bias: Intraday Bullish Above Bearish below 7510

Above 7550 opens 7660

Primary resistance is 7660

Primary objective 7330

20 Day VWAP bearish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!