Will EUR/USD Test Parity Next Year? A Deep Dive Into the 2025 Outlook

The past three months have brought considerable turbulence in global currency market, with the EUR/USD pair offering a prime example of just how quickly market sentiment can shift. At the start of the year, the Euro traded close to 1.10 against the US Dollar, later climbing as high as 1.12 by September. However, after the US elections sentiment on Euro shifted drastically prompting the pair to nosedive below 1.0350 in December.

Below is a comprehensive review of the main drivers behind this volatility, alongside interpretations of the latest economic statistics and possible implications for 2025.

ECB’s Rapid Policy Reversal and Eurozone Balance of Risks

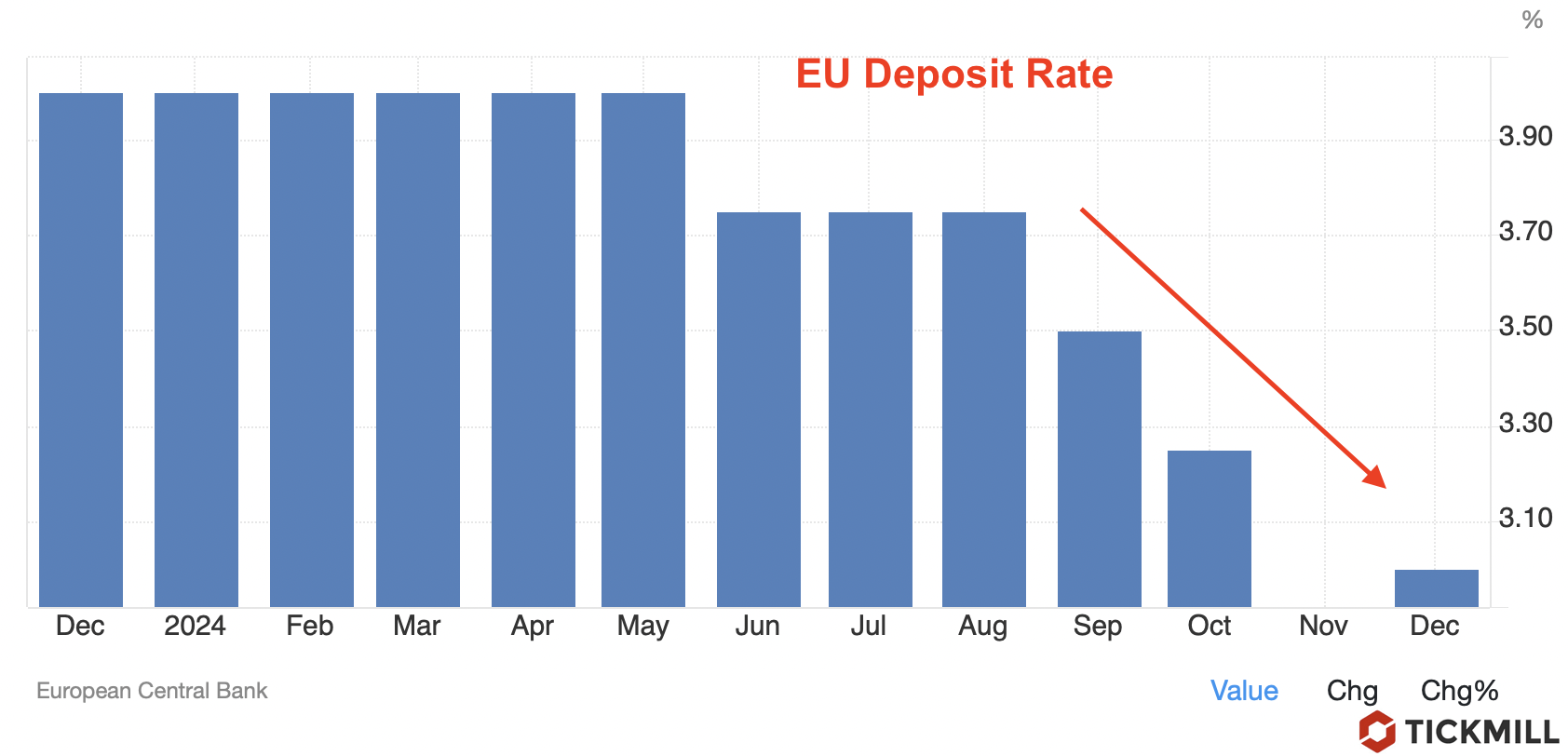

For much of the first half of the year, financial headlines focused on the disinflation trend that gathers momentum and speculation that major central banks would soon relax their tight policy stances. These hopes faded after the US elections with Trump agenda spoiling EU economic outlook due to tariff threats and other political measures. Contrary to what many had anticipated, the ECB opted for monetary easing: by December, the institution had enacted four rate cuts in 2024. After the latest 25 basis-point reduction, the main refinancing rate stands at 3.15%, the marginal lending rate at 3.4%, and the deposit facility at 3.0%:

What forced the ECB’s hand was not success on the inflation front alone but apprehension over tepid economic activity. Indeed, the Eurozone’s HICP (main inflation metrics) dropped to 1.7% YoY in September, far below the 10.6% recorded in 2022. Although it inched up to 2.2% in November, policymakers remained uneasy about growth. Eurostat’s data showed that seasonally adjusted GDP grew 0.9% YoY in the third quarter of 2024, thanks partially to a 0.4% improvement in the last three months. Meanwhile, the PMI signaled persistent contraction in manufacturing, as the EU Composite PMI sank to 49.5 in December—quite distant from the 60.2 peak seen in 2021.

Consumption has remained particularly feeble, raising suspicions that the bloc may yet face a recession. Weak domestic demand is expected to continue into 2025, keeping monetary policy on the looser side, even if inflation temporarily remains above the ECB’s near-2% target. Further clouding the outlook are political complications within the bloc’s largest economies. France’s cabinet resigned en masse following a no-confidence motion, and Germany’s coalition government collapsed after a non-confidence vote on Chancellor Olaf Scholz. Far-right and far-left parties, skeptical of deeper EU integration, are now gaining ground, exacerbating concerns about the region’s political and economic cohesion.

US Dollar Strength and the "Trump Trade"

In contrast, the US Dollar emerged as a standout performer for the year. The Dollar Index reached 108.55 on December 20, representing a notable surge for the third straight month. Though markets had braced for a turbulent election cycle, the win of President-elect Donald Trump and a unified Republican government emboldened USD bulls. Investors responded positively to the prospect of tax cuts and higher tariffs, fueling a rally in US equities, while also anticipating that inflationary risks might rise if consumer demand accelerates further.

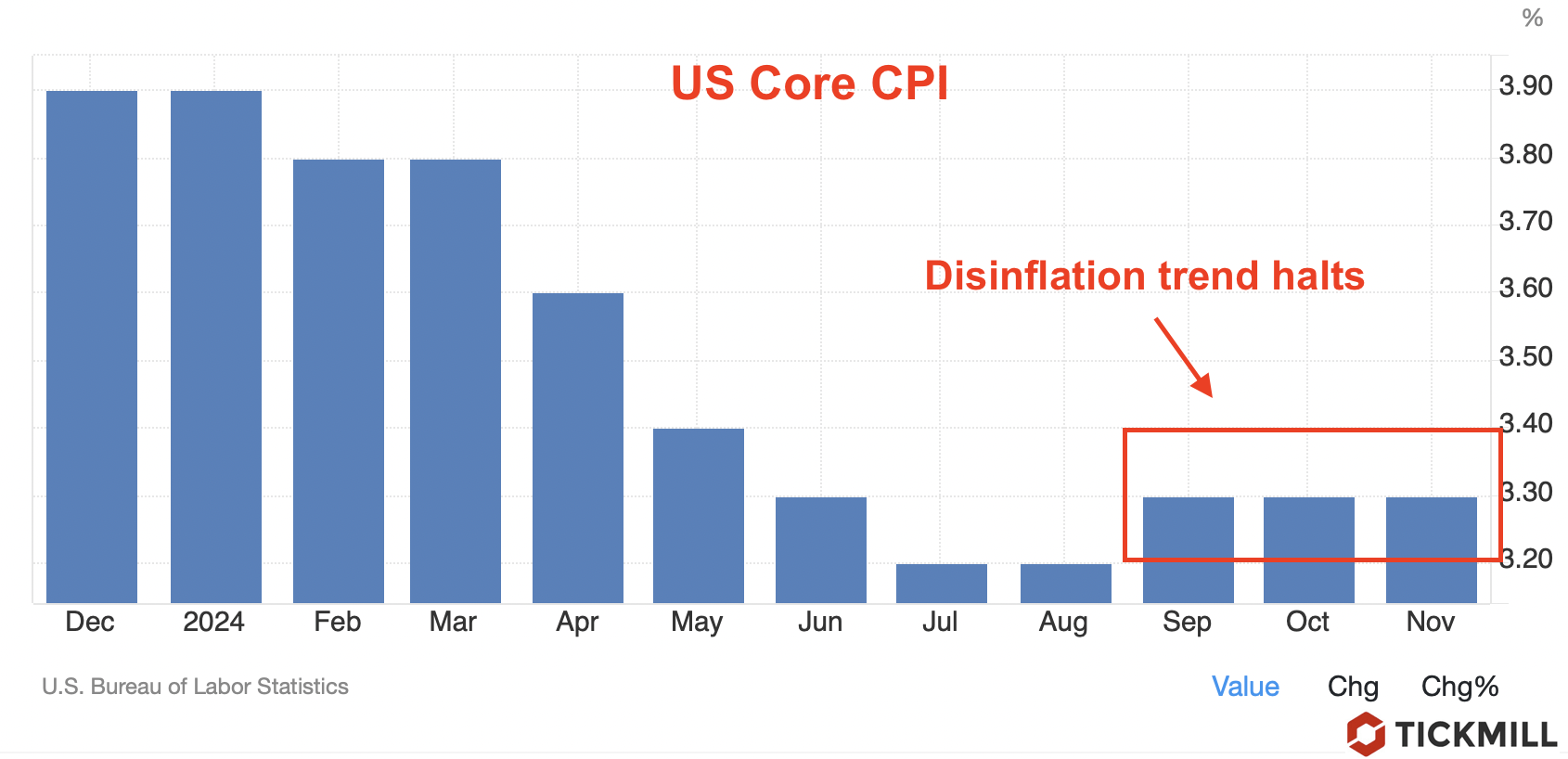

These inflation concerns coincide with a Federal Reserve that has already pivoted away from its previous restrictive approach. After bringing interest rates to multi-decade highs, the Fed implemented three consecutive cuts in 2024: a 50 bps move in September, then 25 bps reductions in November and December, setting the federal funds target range at 4.25%-4.50%. November’s CPI data showed a 2.7% YoY increase—up from 2.6% in October—while the core CPI rose 3.3%. With inflation still above the Fed’s goal, policymakers suggested that rate cuts in 2025 would be limited to two, half of what they had hinted at in September’s forecasts:

Despite lingering concerns about a recession early on, the US economy ended 2024 in stronger shape.

GDP expanded at an annualized 3.1% in the third quarter, supporting optimism that a hard economic landing might be avoidable. Wall Street capitalized on this sentiment, hitting uncharted highs as the year wound down. Profit-taking emerged after the latest dot-plot revealed fewer rate cuts than previously anticipated, yet stock indexes generally remained near their record levels.

Looking Ahead to 2025: Policy Divergence and EUR/USD Outlook

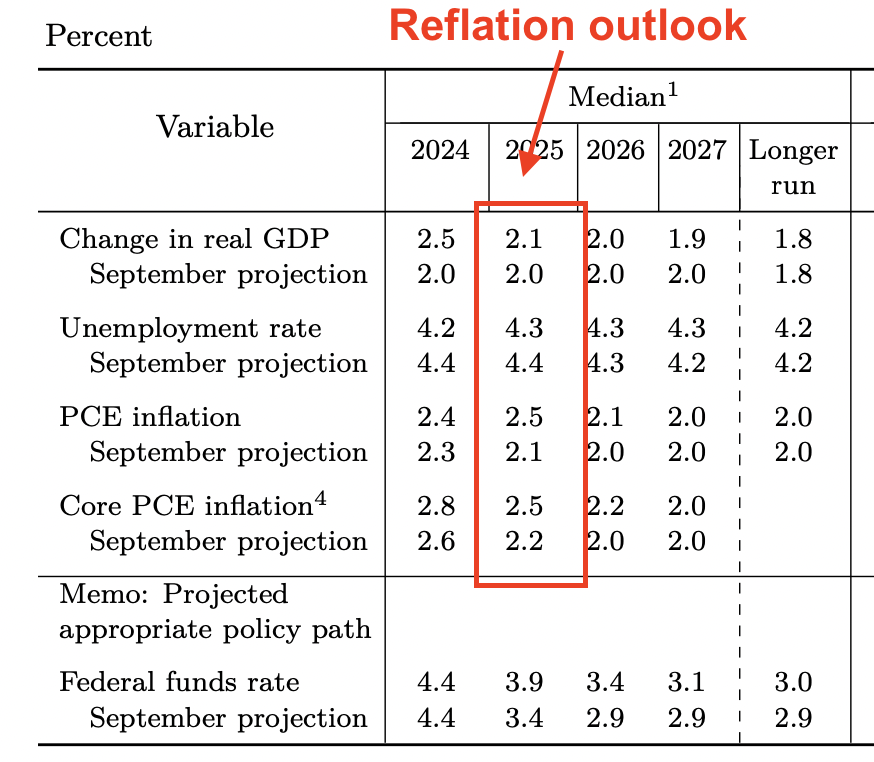

The Fed has upgraded its 2025 GDP growth estimate to 2.1% (up from 2%), but the forecast then drops toward a longer-term growth rate of 1.8% from 2026 onward. Simultaneously, inflation projections for 2025 were revised to 2.5%, with core readings at 2.5%:

Meanwhile, the ECB projects headline inflation dipping to 2.1% and core inflation landing at 2.3% in 2025, before both settle at 1.9% by 2026. Economic growth forecasts in the EU have been trimmed to 1.1% in 2025 and 1.4% in 2026. Taken together, these estimates highlight a growing wedge in monetary policy: the Fed grapples with possible upside inflation risks, while the ECB grapples with subpar growth and political turbulence.

Technically, Dollar index (DXY) continues to trade on the offensive. The price has been rising three consecutive months. Indicators point north, hinting the market may probe levels above 109 soon and possibly test 110—if Eurozone fundamentals continue to deteriorate while Trump administration will keep its promises to punish US partners for “unfair trade”. Should that risks materialize, EURUSD parity at 1.0000 appears within reach:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.